Accounting firm Growth: From Compliance to Embedded Advisory

The Evolution of the Advisory Services Delivery Model in UK Accounting Firms

Across the UK accountancy market, advisory is no longer an optional add-on. Clients increasingly expect help navigating decisions, trade-offs, and uncertainty, not just accurate historical reporting.

Yet “advisory” is often used as a catch-all term, masking very different delivery models and levels of maturity. In practice, firms sit at distinct stages, each with its own constraints, economics, and client impact.

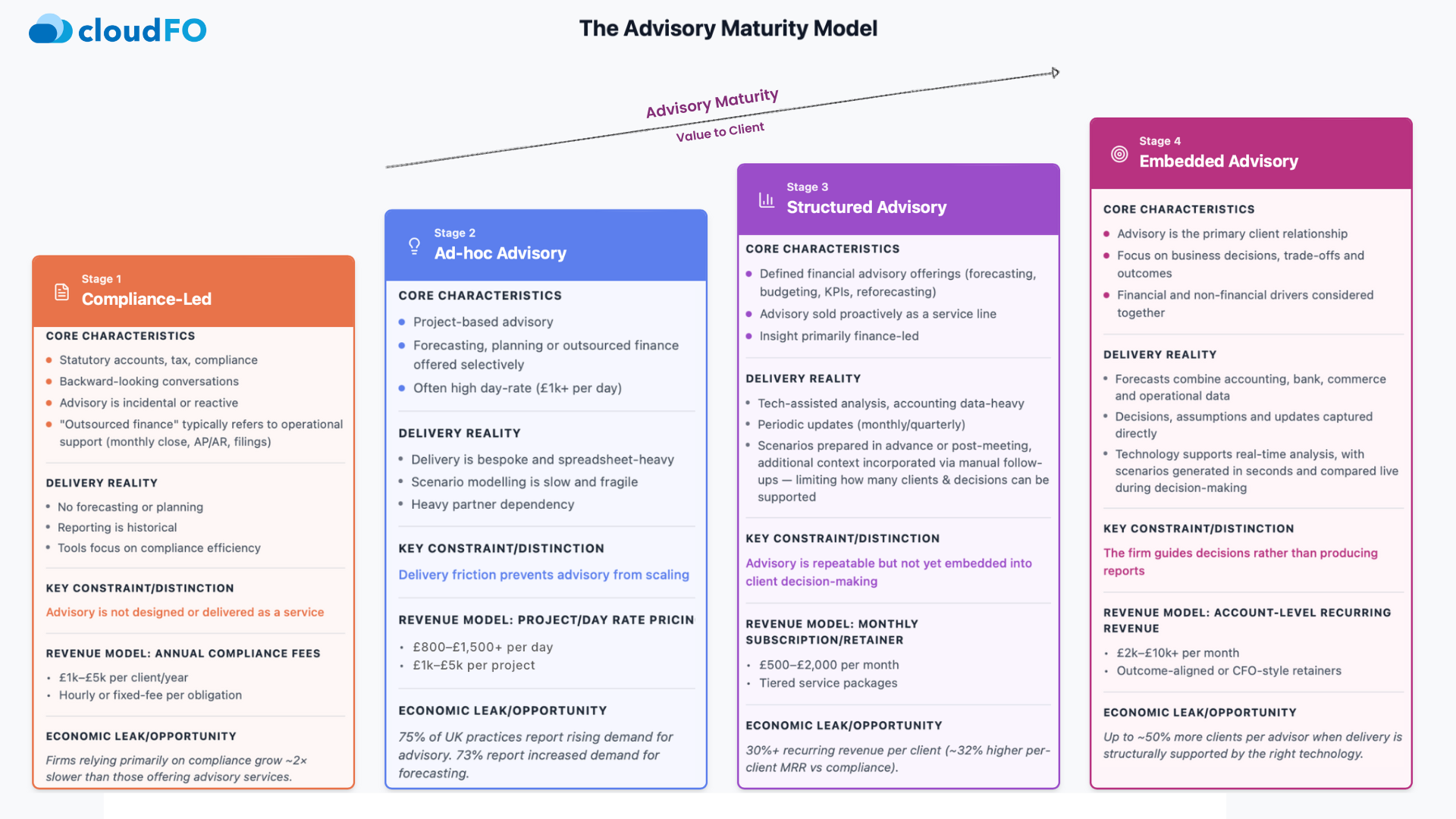

The visual above sets out four stages in the evolution of advisory in UK firms, culminating in Embedded Advisory, where insight is fully integrated into client decision-making.

Stage 1: Compliance-Led Services

Obligation-driven, transactional and backwards-looking

At Stage 1, a firm’s core role is about fulfilling statutory accounts, tax and regulatory obligations. Client interactions are functional and periodic, often annually or quarterly, with no ongoing commercial rhythm. The advisor is seen as a fulfiller of compliance tasks rather than a partner in business progression.

Advisory may occur, but only incidentally and typically in response to a client question after the fact. There is no formal forecasting or planning capability, and “outsourced finance” usually means operational support such as bookkeeping, payroll, or monthly close.

- Client relationship: Transactional, compliance first, insight optional

- Revenue left on the table: With pricing capped by compliance expectations (~£1k–£5k per client per year), firms forgo opportunities for recurring strategic fees.

- Skills & capability focus: Compliance and reporting proficiency dominate; strategic insight is not expected.

- The limitation: Advisory is tactical rather than strategic.

Stage 2: Ad-Hoc or Bespoke Advisory

Insight exists, but it doesn’t scale

At Stage 2, firms start to respond to client demand for forecasting, planning and insight but primarily on a bespoke basis. The relationship deepens around specific projects or business events, yet remains episodic.

Work is often bespoke, spreadsheet-driven, and reliant on senior individuals within the firm. Each engagement feels custom and manual, making scalability difficult. While day rates can be attractive, delivery friction limits capacity and consistency.

- Client relationship: Engaged around specific issues, but not integrated into ongoing decision cycles.

- Revenue left on the table: Attractive one-off project fees (£1k-£5K) replace the opportunity for recurring revenue streams.

- Skills & capability focus: Growing need for analytical skills, including basic forecasting and planning, but not consistently embedded in firm capability.

- The limitation: Advisory depends on particular individuals rather than a structured, repeatable model.

Stage 3: Ongoing Advisory Services

Defined service line, finance-led, with emerging scalability limits

Stage 3 marks a structural shift. Advisory becomes a defined, ongoing service rather than a series of one-off projects.

Firms package offerings such as budgeting, forecasting, KPI reporting, and periodic reforecasting into subscription or retainer models, often positioned as premium tiers or delivered through custom pricing. Client conversations become more frequent, and the advisor becomes a regular part of the client’s financial rhythm.

However, delivery is still largely finance-led. Insight often relies primarily on accounting data, with significant manual effort required to build a broader commercial context. This creates gaps between financial analysis and the full operational reality of the business, limiting how effectively advisory can inform live decisions.

This stage aligns with what many industry bodies describe as a mature advisory practice built on technology and recurring revenue. Research from CPA.com highlights that firms progressing along formal Client Advisory Services (CAS) frameworks see higher revenue growth and margins as they move beyond transactional work into insight-led relationships.

- Client relationship: Regular and proactive, but still periodic, typically monthly or quarterly.

- Revenue left on the table: Subscription retainers (£500–£2,000 per month) increase lifetime value, but pricing remains constrained by delivery effort and update cycles.

- Skills & capability focus: Firms introduce more structured advisory processes and tools, but often face capability gaps when deeper business insight or more dynamic analysis is required.

- The limitation: Advisory is repeatable, but not yet embedded into real-time decision-making.

Stage 4: Embedded Advisory

Decision-led, outcome-driven, and fully integrated

Stage 4 represents a qualitative shift, not just in services, but in role.

Here, advisory becomes the primary client relationship. The firm operates inside the client’s decision cycle, supporting trade-offs and outcomes as they happen. Financial and non-financial drivers are considered together, with forecasts integrating accounting, banking, and operational data.

Technology enables real-time analysis. Assumptions, decisions, and scenarios are captured in real-time, allowing options to be explored and compared on the spot. The advisor’s role moves decisively from producing reports to guiding decisions.

- Embedded Advisory is where the advisor operates inside the client’s decision cycle, guiding trade-offs and outcomes in real time, rather than producing reports after the fact.

- Client relationship: Fully embedded and continuous, with the advisor acting as an extension of the leadership team.

- Revenue model & unrealised upside: Embedded Advisory supports account-level recurring retainers aligned to outcomes and decision support, typically £2k–£10k+ per month, depending on complexity and scope.

However, without the right technology underpinning delivery, advisor capacity becomes the limiting factor. Manual processes and fragmented data restrict how many of these high-value clients each advisor can support, leaving significant revenue unrealised.

When delivery is structurally supported by the right technology, firms can materially increase advisor leverage, enabling up to ~50% more clients per advisor without compromising quality or depth of insight.

- The limitation (without technology): Embedded Advisory, while relationship-led, is capacity-constrained.

Why Technology Enables the Shift and Why CloudFO Matters

Reaching Embedded Advisory is not just a mindset change. It requires delivery capability at scale, something traditional spreadsheets and point tools were never designed to support.

At Stage 4, advisory depends on the ability to support live decisions, not just produce periodic insight. That requires technology capable of handling complexity, context, and speed simultaneously.

Modern Embedded Advisory depends on:

- Real-time forecasting that updates as assumptions change

- Fast, dynamic scenario modelling and budgeting, grounded in real business context, goals, and decisions

- Integrated financial and operational data, rather than just isolated accounting views

- Collaborative client engagement, enabling advisors and clients to explore options together

- Repeatable, scalable delivery workflows that reduce manual effort

CloudFO is built specifically to enable this evolution. It allows firms to:

- Generate and compare scenarios in seconds, not days

- Collaborate live with clients around decisions and trade-offs

- Reduce delivery friction so advisors spend more time on strategy and outcomes, not spreadsheets (but don't worry, you can still export to CSV if you really love them)

By addressing both capacity and capability constraints, CloudFO accelerates the transition to Embedded Advisory and unlocks higher-value revenue, without requiring every advisor to be a specialist in every technical discipline