Are UK Accounting Firms Being Set Up for the Same Growth as Their US Counterparts?

Why the US Has a Clear Playbook for Firm-Led Advisory and the UK Still Doesn’t

Accounting firms on both sides of the Atlantic face the same structural pressures. Traditional compliance work is increasingly commoditised, technology has flattened fees, and clients now view compliance as necessary but not value-adding, which pushes those services into price-led conversations rather than relationship-led ones. At the same time, clients expect ongoing, forward-looking advice that helps them make better decisions, not just historical reporting. This is driving demand for more strategic advisory services.

In the US, this shift has been met with a coordinated response through Client Advisory Services (CAS), most recently formalised in CAS 2.0 by CPA.com and the AICPA. CAS 2.0 provides firms with a clear framework for delivering advisory services at scale.

In the UK, the same destination is widely acknowledged, but there is no equivalent firm-level framework defining how advisory services should be structured, commercialised or delivered consistently.

What CAS 2.0 actually represents

CAS 2.0 is a distinct service line focused on delivering ongoing, forward-looking insight to clients.

Under CAS 2.0, firms evolve from:

- Producing historical financial information to support better business decisions on an ongoing basis

That advisory value is delivered through a range of capabilities, including:

- Cashflow planning and forecasting

- Budgeting, reforecasting and scenario analysis

- FP&A and performance analysis

- KPI monitoring and business insights

- Strategic and operational decision support

- Market and commercial analysis

These capabilities are mechanisms, not the service itself. The service is the advisory relationship, which provides continuous business planning and guidance.

What CAS 2.0 enables and why it matters

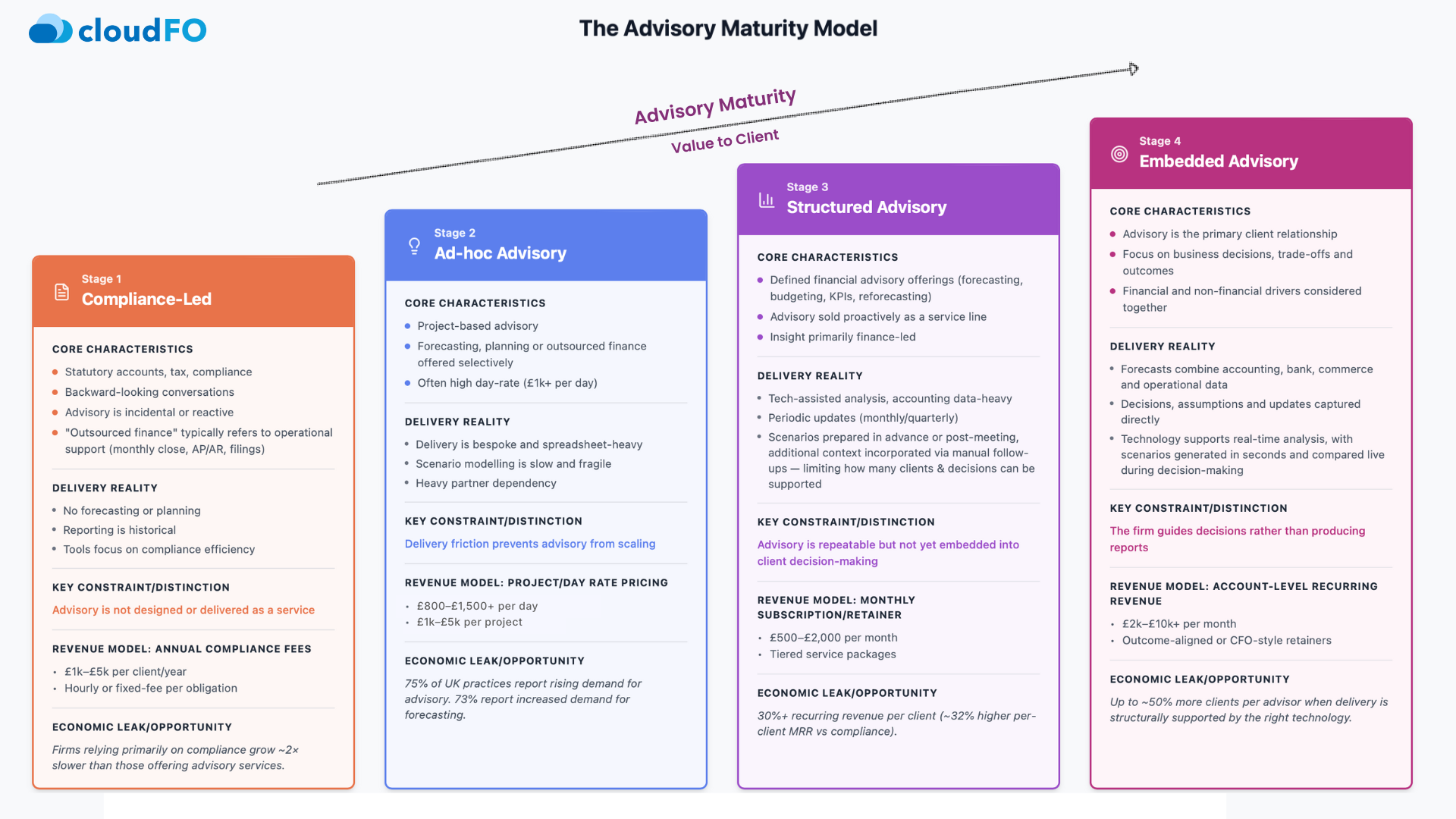

In the USA, CPA.com defines advisory maturity as a progression from CAS 1.0 (recurring, finance-led advisory) to CAS 2.0 (embedded, decision-centric advisory). CAS 2.0’s contribution is not the promotion of individual techniques in isolation, but the codification of advisory delivery as an ongoing, scalable operating model for firms.

Specifically, CAS 2.0:

- Clearly separates advisory services from compliance and assurance

- Establishes expectations around ongoing cadence, scope and value, rather than one-off engagements

- Provides a shared language for firms, vendors and advisors to describe how advisory work is delivered and monetised

In doing so, CAS 2.0 legitimises advisory not as an occasional add-on, but as an ongoing way of working with clients.

At the most advanced stage of CAS maturity, firms are delivering ongoing Client Advisory Services that go well beyond periodic reporting. In this model, the firm maintains a continuous advisory relationship, supports planning, performance and decision-making throughout the year, and acts as a trusted advisor embedded in client decisions.

Capabilities such as forecasting, scenario modelling, budgeting, performance analysis and reporting are not incidental to this model; they are what make it possible. CAS 2.0 recognises that advisory at scale depends on platforms and tools that surface assumptions, model alternatives and explain impacts clearly, enabling advisors to move from producing information to supporting real-time decisions.

CPA.com’s 2024 CAS Benchmark Survey shows CAS practices reporting strong growth and improved recurring revenue outcomes compared with traditional services, with CAS services lines growing at 2X that of overall firm growth.

The UK position: agreement on outcomes, not on structure

UK professional bodies broadly agree on where finance is heading.

- CIMA emphasises planning, performance management and finance business partnering

- ACCA promotes strategic finance, analysis and decision support as core professional capabilities

- ICAEW discusses advisory services, practice growth and digital transformation

However, this guidance is primarily aimed at:

- Individual professionals, or

- In-house finance teams

There is less explicit, firm-level guidance on how accounting practices should design, package and scale Client Advisory Services.

As a result, “advisory” in the UK remains:

- Broadly defined

- Inconsistently delivered

- Difficult to price with confidence

Many firms deliver elements of advisory work, but without a shared framework that turns intent into a repeatable service model.

A critical difference: regulatory clarity in the US

One factor supporting the growth of CAS in the US is regulatory alignment.

In 2025, the AICPA clarified that when financial information is produced as a by-product of a Client Advisory Services engagement, i.e. the primary objective is advisory rather than reporting, the work does not fall under AR-C Section 70, the standard for preparing financial statements. Instead, it can be treated as a consulting engagement.

This clarification matters because it:

- Explicitly separates advisory work from financial statement preparation

- Reduces regulatory friction for forecasting, budgeting and scenario analysis

- Gives firms confidence to package and price CAS without unintended compliance obligations

There is no equivalent clarification in the UK, which contributes to more cautious and fragmented approaches to advisory service design.

So what is actually driving Client Advisory Services in the UK?

Despite the lack of institutional coordination, Client Advisory Services are growing in the UK, driven by four forces.

- Client demand is the most immediate driver. UK businesses increasingly expect visibility, resilience and decision support, not just year-end reporting. Industry research shows that 75% of UK accounting practices report rising demand for advisory services, particularly in areas such as business strategy and financial planning. More specifically, 73% report increased demand for forecasting services, indicating that forward-looking insight is becoming a baseline expectation.

- Technology platforms are accelerating this shift. Modern forecasting, planning and analysis tools have lowered the barrier to delivering forward-looking insight, making advisory services more accessible and repeatable for firms of all sizes.

- Talent expectations are also reshaping service models. Accountants increasingly want work that involves judgement, interpretation and influence, rather than purely transactional reporting. Advisory services provide clearer progression paths and support retention.

- Private Equity commercial and scale pressures are pushing firms toward advisory. Growth-oriented and private-equity-backed practices are focused on increasing revenue per client and moving from “year-enders to year-rounders”. Evidence from CPA.com’s CAS Benchmark Survey shows that firms with defined advisory and insights offerings achieve materially stronger economics, with those focused on higher-level advisory reporting around 30% higher recurring revenue than firms without structured advisory services.

Turning advisory demand into day-to-day delivery

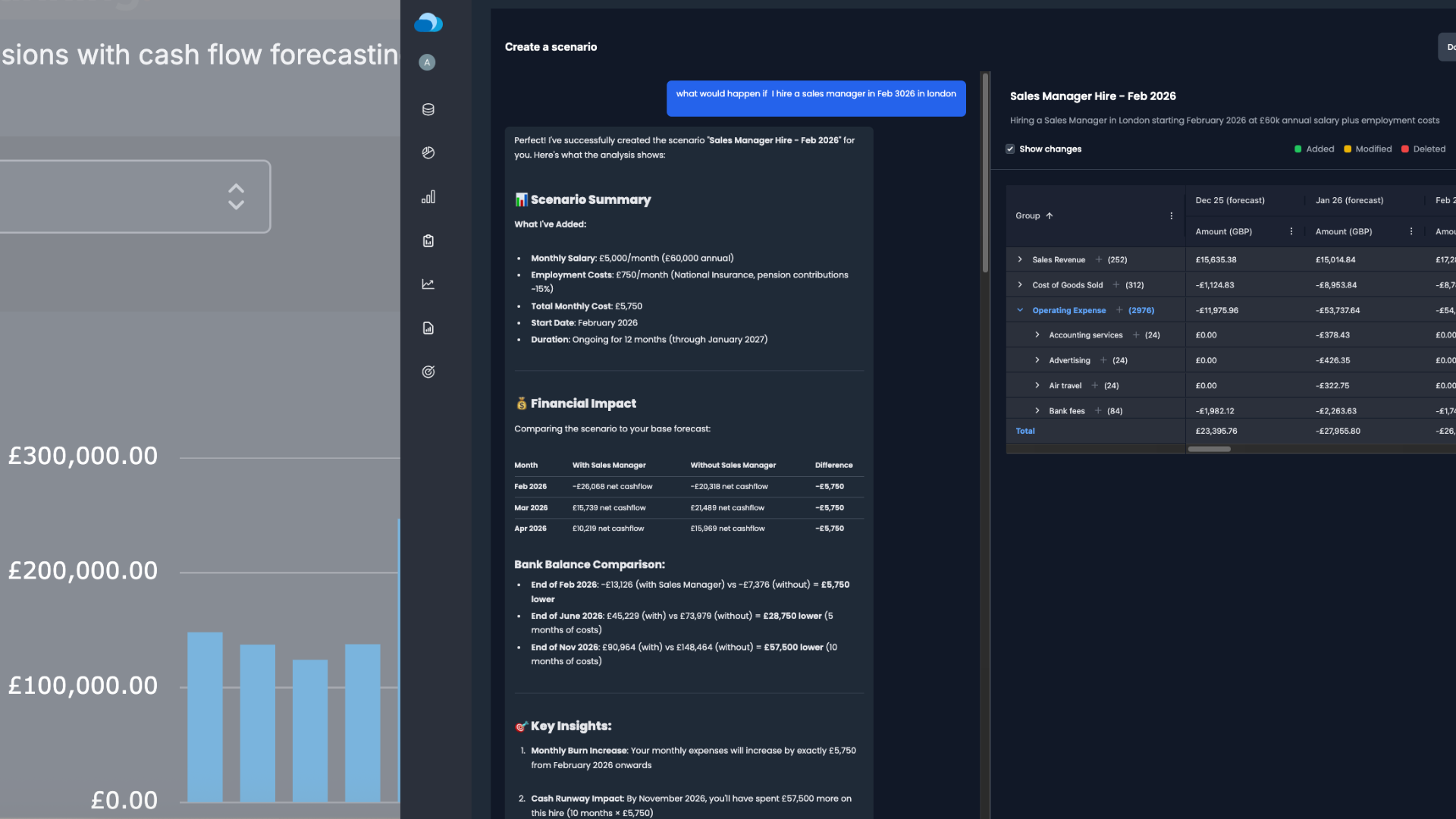

In practice, the growth of Client Advisory Services is being enabled by platforms designed around decision-making and strategic support, not just reporting. Solutions such as CloudFO address rising client demand for advisory by giving accountants and advisors a live, forward-looking view of the business combining forecasting, scenario modelling, budgeting, KPI monitoring, automated financial statements and analytics in a single decision-support environment.

This allows advisors to work alongside clients in real time, exploring the financial and strategic implications of decisions such as hiring, pricing or growth plans, with assumptions made explicit and outcomes visualised clearly. Rather than producing isolated forecasts or reports, platforms like CloudFO support the core CAS objective: helping business owners understand their options, assess trade-offs and make better decisions on an ongoing basis.

Comparing approaches

Conclusion: convergence without coordination

The US and UK are moving toward the same future: accounting firms delivering ongoing advisory that helps clients plan, adapt, and make better decisions.

The difference lies in how that future is being shaped.

In the US, advisory growth has been coordinated through CAS 2.0, supported by regulatory clarification and shared industry frameworks. In the UK, the same destination is being reached through a different route, driven by client demand, technology adoption, talent expectations, and commercial pressure rather than formal classification.

This is where platforms like CloudFO matter. By providing a live, forward-looking baseline forecast and bringing planning, performance, and scenario analysis into a single environment, CloudFO allows client goals and decisions to be modelled in seconds. It enables firms to move from one-off advisory activity to an ongoing way of working with clients.

There is no denying client demand in the UK. With or without a coordinated framework, clients are already reshaping firm behaviour, treating compliance as a cost and advisory as the source of value. The firms that adapt to this reality will not wait for definition; they will create it.