Autumn Budget 2024 for Small Businesses & Startups: What UK Founders Need to Know

The new Labour Chancellor, Rachel Reeves, has announced the UK’s Autumn Budget, featuring significant changes for small businesses, startups, and founders. With adjustments to National Insurance, minimum wage, capital gains tax, and research funding, these shifts may impact how founders and small business owners navigate costs and growth. Below is an easy-to-digest guide on what you need to know and how it might affect your bottom line.

1. Employer National Insurance Contributions (NICs)

From April 2025, businesses will pay more in NICs for each employee, with the rate increasing to 15%. Employers will also need to start paying NICs on an employee’s earnings at £5,000 a year instead of £9,100.

To help offset these costs, small businesses can benefit from an increase in the Employment Allowance, which will double from £5,000 to £10,500, providing qualifying businesses with a greater discount on NICs. This change aims to ease the burden on smaller businesses, though for those with larger workforces, it could still mean significantly higher employment costs.

Bottom Line: NIC increases will likely add to payroll costs, so it's important to budget for these shifts in 2025. The boost in Employment Allowance should help small businesses offset some of these costs, so check eligibility to maximise savings.

2. Minimum Wage Increases

Starting in April 2025, the National Living Wage is set to increase by 6.7% to £12.21 per hour, with the minimum wage for 18-20-year-olds rising 16.3% to £10 per hour. For businesses with younger employees or those on entry-level wages, this will mean higher payroll costs.

A report by the Learning and Work Institute and Carnegie UK Trust showed that more than half of employers support an increase in minimum wage to help improve worker productivity, around 22% said they would need to pass on some of the cost to customers through price increases, while 15% said they would likely hire fewer staff members.

Bottom Line: Be sure to factor in the rise when planning, hiring, or managing your payroll budget, especially if you rely on entry-level employees.

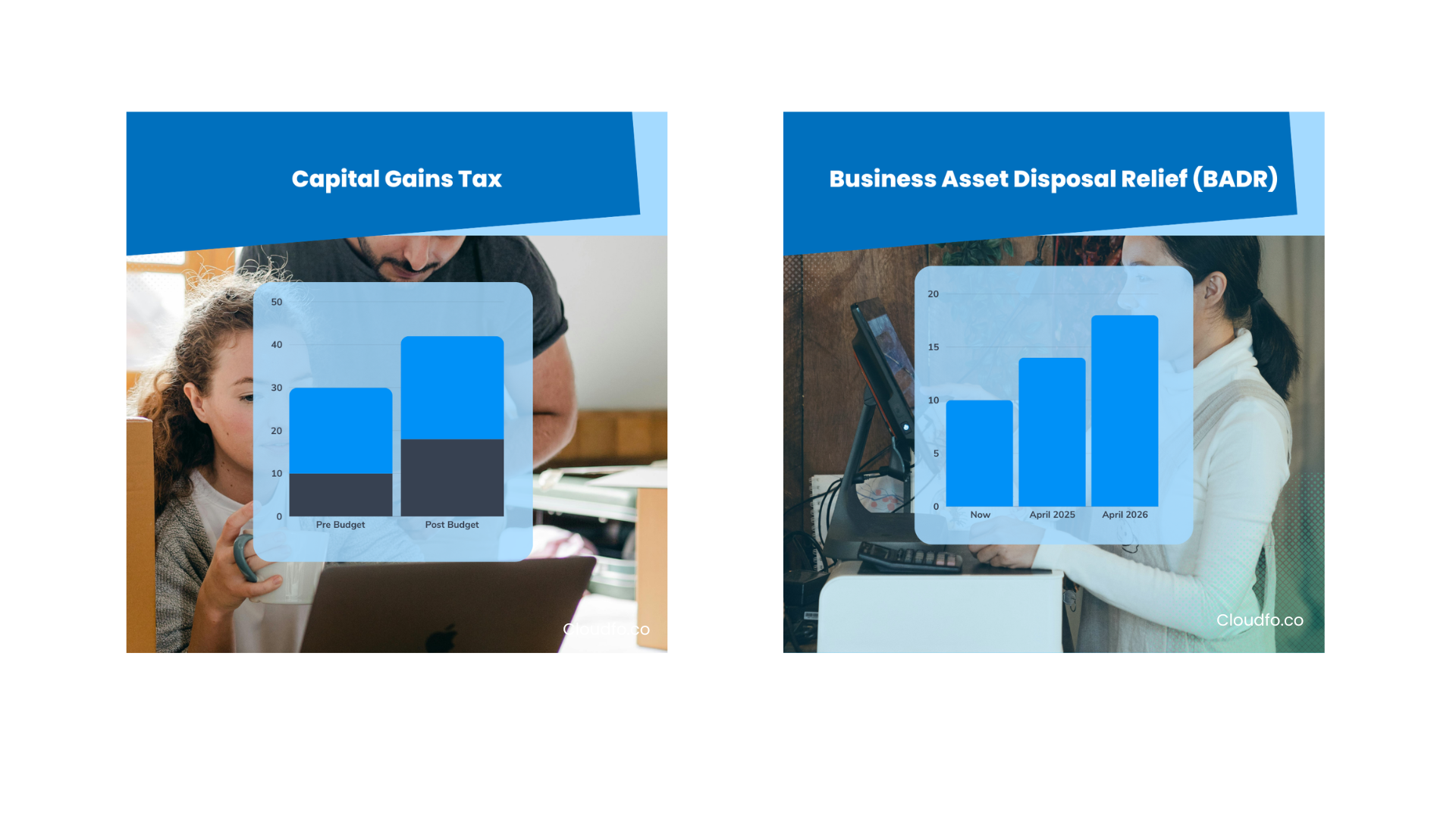

3. Capital Gains Tax (CGT)

The Capital Gains Tax (CGT) rate on most assets sold for a profit is increasing—effective immediately. The rate will jump to 18% for basic rate taxpayers (up from 10%) and 24% for higher earners (up from 20%) on gains over £3,000. This applies to gains from selling assets like shares, making it particularly relevant to founders & shareholders looking to sell their companies or sell shares.

Bottom Line: If you plan to sell assets like shares, higher CGT rates will mean more of your profit goes to taxes. Consider these new rates in your exit planning.

4. Business Asset Disposal Relief (BADR)

Business Asset Disposal Relief (BADR) offers a reduced 10% Capital Gains Tax rate on qualifying business sales up to a lifetime limit of £1 million. While this 10% rate will stay for now, it will increase to 14% in April 2025 and 18% by 2026. This relief can help founders save significantly on taxes when they exit a business.

Bottom Line: Plan exits with these upcoming rate changes in mind. BADR will still provide tax savings, but the gradual rate hikes mean you may want to consider your timing if you’re planning a sale.

5. Business Rates Changes

Starting April 2026, business rates (taxes on business properties based on property value) will lower for smaller shops and restaurants valued under £500,000, with the aim of supporting high street businesses. This relief will be funded by increasing rates on larger properties, often used by big online retailers (think large warehouses), as the government aims to help local retail and hospitality businesses compete with eCommerce and inflation pressures.

However, in 2025-26, retail and hospitality businesses will see their rates relief decrease from 75% to 40%, with an annual relief cap of £110,000. For now, the small business rates multiplier will stay at 49.5p for 2025-26.

There's been little discussion about whether the increased rates on warehouses for eCommerce will affect small eCommerce businesses that rely on third-party warehousing and fulfilment solutions.

Bottom Line: If you own or operate a high-street retail or hospitality business, prepare for rates relief to decrease next year, resulting in higher costs. Some help may come in 2026, but more reforms are planned, so we will keep you posted.

6. R&D Investment and Tax Credits

The government has pledged to continue R&D funding through grants and tax credits. This is encouraging news for tech or product-focused startups, as there will be investment in areas like; green energy, aerospace, and NHS digital solutions. However, relief for generative AI won’t be included, and funding for AI supercomputers that the previous government planned has been cut, potentially limiting R&D funding for GenAI-driven startups.

Additionally, tax relief for creative industries, especially VFX in TV and film, has been improved. There's also a £25 million allocation for redeveloping the Crown Works Studios in Sunderland, projected to create 8,000 jobs.

A new capital grants program called the Life Sciences Innovative Manufacturing Fund (LSIMF) is being introduced to boost investment in drug and medical technology manufacturing.

Bottom Line: Innovation-focused startups can benefit from continued R&D funding, especially those in green tech or healthcare. While generative AI startups may face reduced relief options, there are still vast opportunities in the broader AI landscape. For example, at CloudFO, we leverage various AI and machine learning techniques to power and enhance our AI Finance Colleague and create innovative user experiences. So, plan accordingly and explore all the avenues available!

7. Corporation Tax

There are no changes to corporation tax in this budget. Larger businesses will continue to pay 25%, while smaller companies will benefit from a lower rate.

Bottom Line: Corporation tax remains stable, which could aid in financial planning without worrying about immediate hikes.

8. Carried Interest

The carried interest tax rate, which applies to profits earned by fund managers, will increase by 4% to align with the new higher CGT rates. For founders looking to attract private equity or venture capital funding, this might mean that some funds feel less incentivised to invest in the UK.

Bottom Line: As carried interest becomes pricier, founders could see fewer investment funds targeting UK startups. This could mean increased competition for available funding or pressure to seek capital from other sources.

Conclusion

This budget presents a mixed bag for UK startups and small businesses. Increased NIC rates and minimum wages will affect payroll costs, and higher CGT rates may impact those selling company shares or assets. However, there’s still support for R&D, and business rates changes are intended to help high-street businesses long-term. For founders, understanding and preparing for these changes will help you stay resilient and potentially even find new growth opportunities amidst these shifts.

How CloudFO Can Help Your Business Navigate These Changes

CloudFO stands ready to help you meet these changes with confidence.CloudFO the AI Finance Colleague is always there to provide precise tracking and management of income, expenses and financials, allowing you to:

- Understand Cash Flow Impacts: Clearly see how changes in tax rates and operational costs affect your bottom line, enabling you to plan strategically

- Model Scenario Planning: Run various financial scenarios in response to wage increases or NIC adjustments, ensuring you can afford changes without straining your budget.

- Track Financial Health: Monitor your financial data closely to make informed decisions, whether you’re managing increased payroll or planning to capitalise on business rate reliefs.

Further definitions

*National Insurance Contributions (NICs)

NICs are taxes paid by UK businesses and employees to support public services, including the NHS, pensions, and social benefits. Employers pay NICs based on their employees' earnings, which adds to payroll costs, while employees also contribute a portion of their income.

*Capital Gains Tax (CGT)

Capital Gains Tax is a tax on the profit made from selling or disposing of an asset, such as property or shares. In the UK, individuals and businesses must pay CGT on gains that exceed a certain threshold, which is applied to the difference between the selling price and the original purchase price.

*R&D Tax Credits

R&D tax credits are government incentives designed to encourage businesses to invest in research and development. These credits allow companies to reduce their tax bill or receive cash payments based on eligible R&D expenditures, helping to stimulate innovation and growth in various sectors, including technology and manufacturing.