Bridging the SMB Banking Gap With AI and Embedded Finance

How AI and Embedded Finance Are Key to Rebuilding Trust in Business Banking.

Small and medium-sized businesses (SMBs) are the backbone of the UK economy, making up 99% of firms and driving over half of private sector turnover. Yet, despite their critical role, many continue to experience friction when accessing financial products and services.

Our recent research collaboration with Loughborough University explored how AI and digital innovation can help banks close this service gap and build more resilient, trust-based relationships with SMBs.

We found that 47% of SMBs use no financial tools, and only 16% rely on bank-provided solutions - even though 89% want better cash-flow forecasting and 58% want automated insights. This mismatch highlights a major opportunity for banks to embed smarter, more connected support into SMB workflows.

The Urgency for Change

As business operations become increasingly digital-first, SMBs now expect banking experiences that mirror the seamlessness of modern commerce - fast, personalised and proactive. Yet legacy infrastructure, regulatory constraints and fragmented data continue to hold many banks back, allowing fintechs and challengers to capture market share through simpler, more customer-centric design.

However, this is not the end for traditional banks. It’s a wake-up call - and an opportunity to redefine their strengths. Fintechs have set new expectations for speed and usability, but banks hold a deeper advantage: the trust, scale and regulatory discipline to deliver innovation that’s both intelligent and reliable.

The real opportunity isn’t just to modernise systems, but to modernise relationships - to combine the stability SMBs already associate with banks, with the agility and foresight they now expect from digital providers.

Those that achieve this balance will not only regain competitiveness, but reshape what ‘trusted’ banking means in a digital era.

Bridging the Service Gap: Understanding the Disconnect

Lending still relies heavily on historical statements rather than live data - meaning weeks-long decisions at a time when SMBs need agility.

For banks, this challenge isn’t a lack of awareness but a structural reality: legacy technology, complex regulation, and competing priorities have made transformation difficult. Meanwhile, digital challengers have stepped in, using automation and integrated platforms to simplify onboarding, accelerate lending and offer more connected financial experiences.

The result is a widening service gap - not just in speed, but in relevance. SMBs still depend on banks for trust and stability, yet increasingly turn to fintechs for the tools and insights that help them operate day-to-day. Without targeted innovation, traditional institutions risk losing their foothold in one of the most commercially and socially vital segments of the economy.

The Embedded Finance Advantage

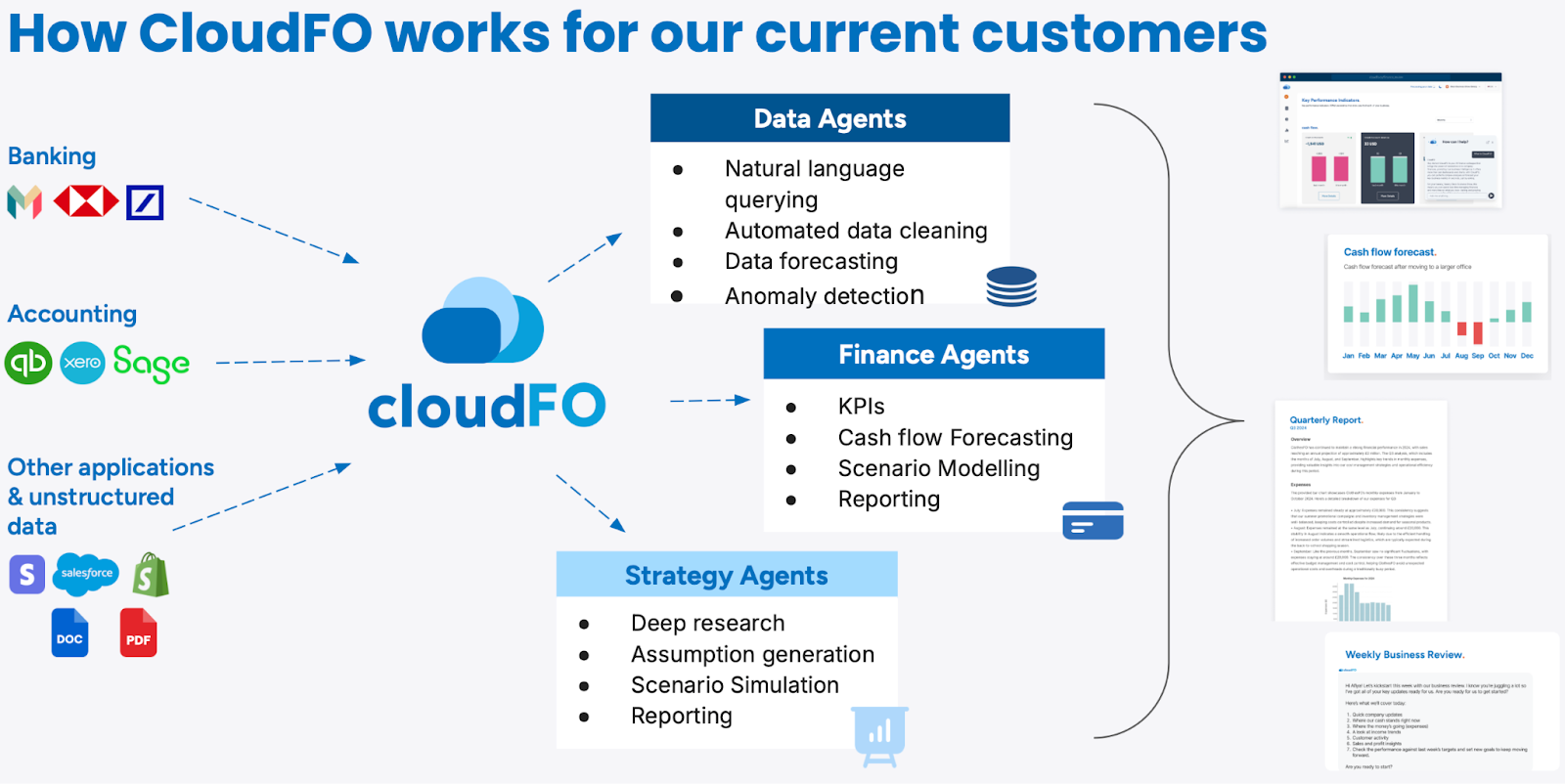

Embedded finance offers a pathway to close these gaps. By connecting banking systems directly into SMB workflows - accounting, payments, payroll and commerce platforms - banks gain access to live, contextual data. This data foundation allows banks to move from reactive to predictive services - anticipating needs before SMBs even raise them.

While these integrations are already helping automate key workflows, their true potential lies beyond current use. By bringing together data from multiple sources, banks can gain a richer understanding of SMB cash flow, performance and behaviour. This deeper visibility can power smarter credit assessments, more accurate forecasting, scenario planning and timely advisory support - strengthening both trust and revenue opportunities.

However, the reality is that execution is complex. Legacy cores, data silos, and compliance requirements mean integrations can’t happen overnight. That’s why modular, partnership-driven innovation is so powerful; it allows banks to modernise in a less risky, incremental way. With the right data orchestration layer, they can begin closing the SMB service gap today, building toward full interoperability over time.

From Transactions to Trusted Partnerships

Banks can leverage these insights in three practical ways:

1. Streamline onboarding through connected systems. Many institutions have begun digitising parts of their onboarding journey, but the next step is integration, connecting identity, credit and document workflows across systems and partners. Doing so creates a more cohesive experience for SMBs and reduces duplication and delay internally.

2. Personalise at scale: strengthen relationship management with data-driven insight. Providing relationship managers with access to timely, actionable data helps them anticipate client needs and engage more strategically. By embedding predictive analytics and contextual alerts into their everyday tools, banks can turn relationship teams into proactive advisors rather than reactive problem-solvers.

3. Deliver continuous value through integrated insights. Embedding forecasting, scenario planning, benchmarking and compliance tools into SMB platforms allows banks to remain present in a business’s daily decisions. Over time, these insights deepen engagement and open opportunities for more tailored, higher-value support - a capability that will only grow in importance to customers in the years ahead.

This transition isn’t just about new technology. It’s about rebuilding trust. SMBs want partners who combine human empathy with data-driven intelligence - banks that are transparent, responsive and proactive.

The Opportunity Ahead

By closing the structural gaps and embedding themselves into SMB ecosystems, banks can reposition from transactional lenders to integrated financial partners, capturing both loyalty and long-term profitability.

The opportunity is clear:

- AI and embedded finance give banks richer insight into SMB performance.

- Advisory-led engagement transforms those insights into trust and revenue.

- Governance and explainability ensure that innovation remains responsible and credible.

The institutions that act now will not only regain ground - they’ll redefine what modern SMB banking looks like, not only meeting SMB expectations but also unlocking new, sustainable revenue models in the process.

Want to Learn More?

For access to the full report or to discuss how your institution can strengthen SMB engagement through data-driven strategy, please get in touch at info@cloudfo.co.