Using Financial Insights for Decision-Making

Guest Post: By Dhosjan Greenaway-Dalini

In an earlier blog post, we touched on the pivotal role of Financial Planning & Analysis (FP&A) in driving informed decision-making. After many years of working within scaling finance teams and businesses, I have seen first-hand the transformative power of financial insights in shaping the trajectory of organisations. But how do we leverage financial data to empower strategic decision-making?

The primary objective of FP&A is the alignment of business operations, with financial goals and strategies. Every business should have a plan - a goal they are trying to achieve and a roadmap for executing that plan. This could be revenue growth, gaining X number of new customers, entering a new market, or achieving a certain profitability level, amongst other goals. These targets should have quantifiable outcomes that a business is working to achieve by a particular date. Monitoring progress against targets allows you to see whether you are on track.

Additionally, a key part of planning is to grasp the granular inputs that drive your revenue, costs and cash flows. Understanding these at a product and customer level will help you make informed decisions as you assess progress against targets.

Let’s look at some impactful areas where financial insights help to drive better decision-making, as well as what impact they have on the business.

Key insights to know

Customer analytics

These are the core facts about where your revenue is coming from. This includes data on the number of customers, location, sector and business types, popular products, average customer spend, revenue generated per period, as well as any seasonality of revenue.

Costs to operate

This refers to how much you are spending on the various functions in your business, be it sales, marketing, production, engineering, direct vs indirect costs, and so on. This applies regardless of whether you are selling a physical product, service or software.

Profitability

This takes us back to basics, as it’s important to understand whether you are generating a profit from your business activities. By understanding the profitability of your products and operations, you gain an understanding of how your bottom line is impacted by your employees’ activities and the deployment of other resources.

Using insights for decision-making

Where to invest

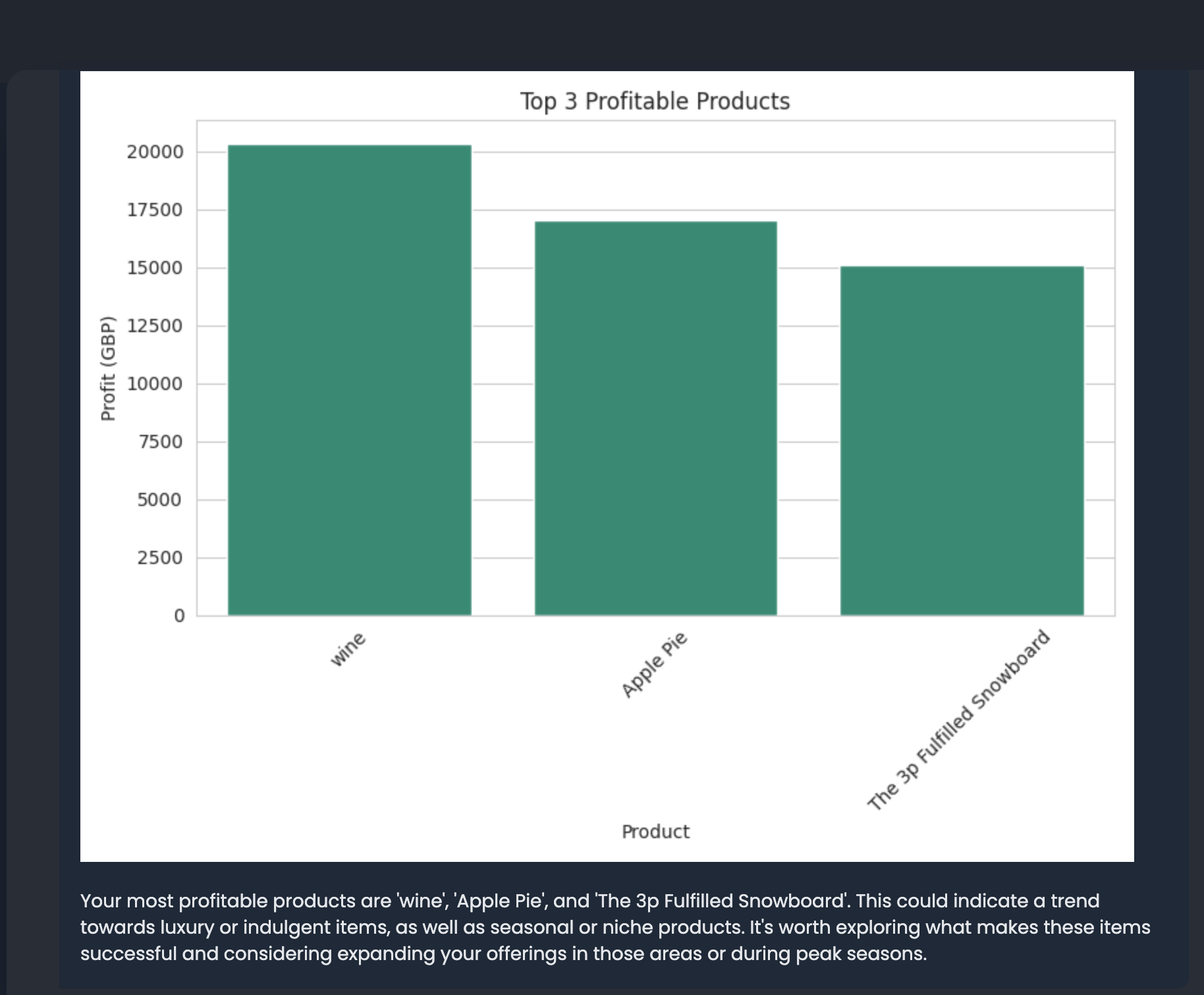

Insights provide guidance on how funding should be allocated and how it might impact growth or even the viability of your business. This helps you to make decisions, such as what your most popular products are, who are your most profitable customer profiles and what activities should be replicated and scaled. For example, if the profit on a particular Product A is positive, additional investment can be directed towards accelerating growth in that product (e.g. marketing). If it is negative, you may choose to optimise the business model in that product by reducing costs/increasing revenue, or you may choose to invest resources in a different Product B.

Risk Assessment

Analysing your financial data allows you to assess the risk associated with certain business activities. For example, cash flow in most organisations is highly dependent on funds received from customers. One key risk area is the seasonality of product sales, and knowing this ensures you have a plan in place to cover operating expenses. Some months may have a significantly lower level of sales and cash receipts than others. Being aware of such seasonality allows for more realistic budgeting and ensures adequate cash reserves to navigate leaner sales months.

Sustainable Growth and Scalability

If the revenue generated from a product exceeds the cost to produce and sell that product, the business model suggests a path to profitability as it scales. This suggests an ability to acquire more customers or sell more products without increasing costs at a higher rate than revenue. This is critical due to the knock-on effect of cash flow. A strong indicator of sustainable growth is a business’s ability to grow its customer base and revenues without proportionally increasing its costs.

Wider Economic Impact

Paying close attention to macroeconomic trends is crucial for effective decision-making. These insights can be quite broad, and cover areas such as supply chain disruption, market activity specific to your client sector, GDP growth rates, inflationary movements, changes to tax rates and proposed amendments to government incentive schemes. Analysing economic activity allows businesses to gauge the overall health of the economy and make informed assumptions about factors likely to impact business operations.

These insights empower risk mitigation. They enable refinement of strategies on where to invest limited resources, plan for likely increases in cost base and pivot from changes in customer demand.

Leveraging Technology

Integrating technology into your business allows you to do more with less. This is even more beneficial to small businesses that are able to amplify their capabilities and compete with larger entities. AI, for example, expedites access to data analysis and insights and supports strategic decisions with only a fraction of the workforce. Business leaders and finance teams are now able to quickly visualise critical KPIs, including cash flow, sales stats, revenue and spending data (in real-time). Enhanced personalisation allows for categorisation of costs based on key focus areas. Utilising AI, empowers recommendations on areas requiring attention, including insights on transaction history and trends that may impact cash runway.

By harnessing the power of technology, teams can gain real-time visibility into financial performance, monitor performance metrics, identify trends, and anticipate potential risks or opportunities. Additionally, enhanced collaboration and communication amongst cross-functional teams is aided by centralised access to financial data and reporting. This fosters alignment and transparency across the organisation, driving better decision-making outcomes.

In summary…

In today's fast-paced business environment, the ability to make informed decisions based on timely and accurate financial insights is more crucial than ever. Data enables decision-making in terms of investment allocation, risk assessment and sustainable growth. By embracing advanced FP&A software platforms, businesses can unlock the full potential of their financial data.

CloudFO provides access to critical financial insights. As your AI Finance Colleague, the platform acts as a member of your team allowing you to instantly have your finger on the pulse of business activities (in real-time). CloudFO seamlessly connects to bank accounts, Stripe, Shopify, Xero, and other data sources. Your AI colleague proactively surfaces actionable insights and trends, enabling businesses to make informed decisions and drive growth.