From Accounting Compliance to Advisory: Why Financial Forecasting Is So Hard (But Doesn’t Have to Be)

Clients are asking their accountants for far more than year-end compliance; they want help planning the future. And that demand is accelerating: CPA.com reports that CAS (Client advisory services) is now growing at nearly twice the rate of the overall accounting profession.

But forecasting is challenging. Online discussions from in-house finance teams share how difficult it is to build and maintain a forecast when they have full access to people, plans and real-time information.

Now imagine trying to do the same work from the outside. No embedded context. No day-to-day visibility. Yet the client expects you to guide their strategy. This is the challenge for many modern firms to overcome.

1. Data is fragmented. Forecasting requires financial + operational signals

Multiple FP&A professionals echoed the same challenge: the General Ledger alone is too limited.

“A lot of producing an accurate forecast comes down to knowing the business inside out. The General Ledger doesn’t tell you the story.”

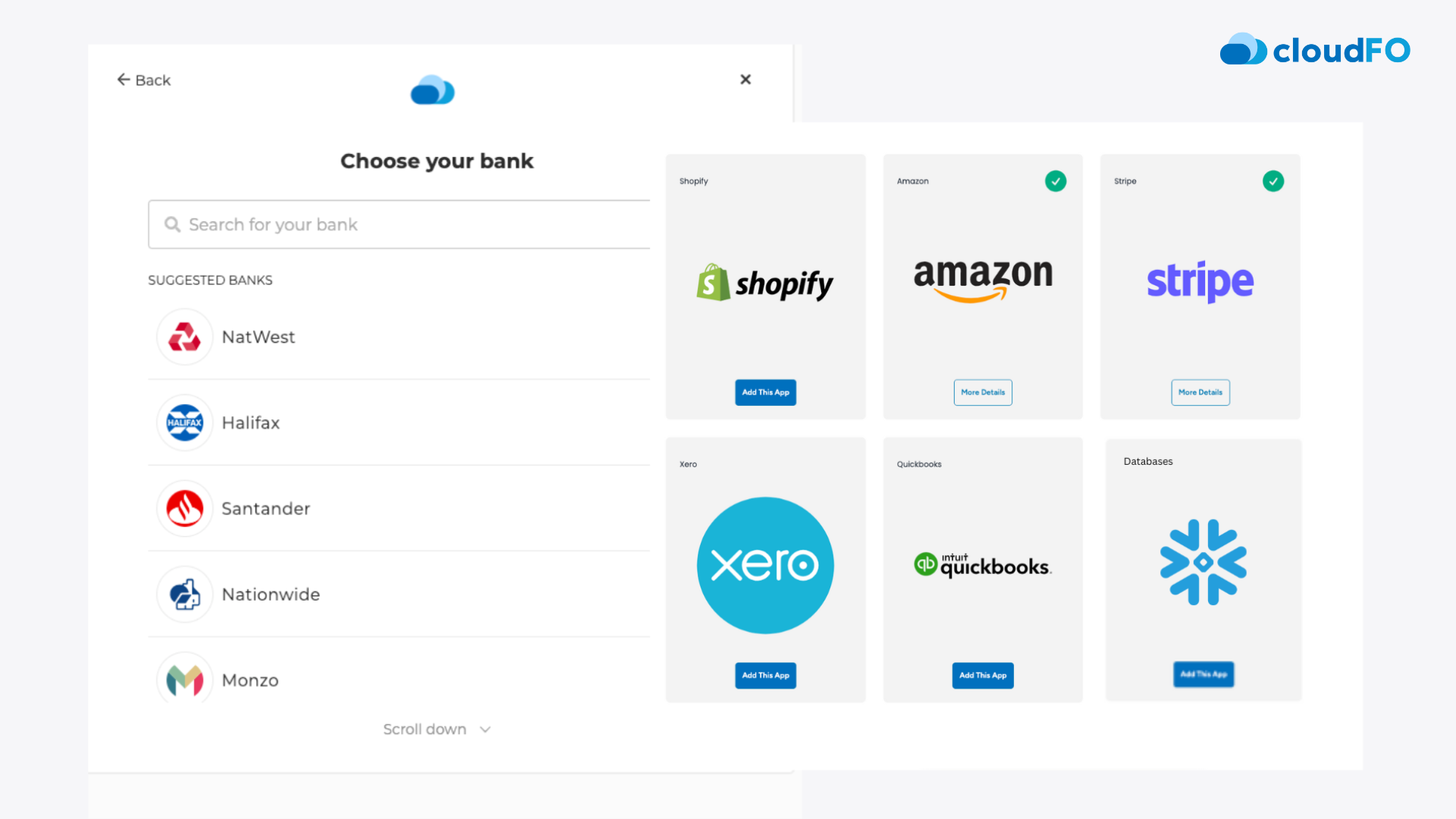

Modern business information, customer transactions and operational data needed for true forecasting is held across dozens of systems, including accounting, banking, commerce, payroll, CRM, inventory, databases, as well as unstructured data like strategy documents, and more.

Yet accountants rarely see all of this in real time. Largely relying on reconciled accounting data.

CloudFO integrates financial and operational systems to create one real-time view of performance, the foundation of accurate forecasting.

2. Forecasting requires deep business knowledge; something external accountants aren’t always given

An FP&A professional put it bluntly:

“Half of forecasting happens outside the numbers: what leaders plan, what teams delay, what the market shifts.”

In-house teams know:

- Who’s being hired next month

- Why delays occurred

- Which invoices are late

- That a supplier changed pricing

- That sales pushed a promo early

- That a founder made an unplanned spend

And beyond operations, in-house teams also know where the business is aiming to go. As one CFO told us: “Most forecasting tools assume the past repeats. They don’t take our growth ambitions or strategic goals into account.”

Great accounting firms and Fractional CFO's work hard to build strong client relationships so they can stay close to this operational reality. But the pace of change today is unprecedented and gathering this context across dozens of clients simply doesn’t scale. Firms end up spending more time chasing information than deepening the Client-Advisor relationship.

This creates a gap: clients want strategic, forward-looking insight, but firms often lack the real-time visibility needed to deliver it consistently.

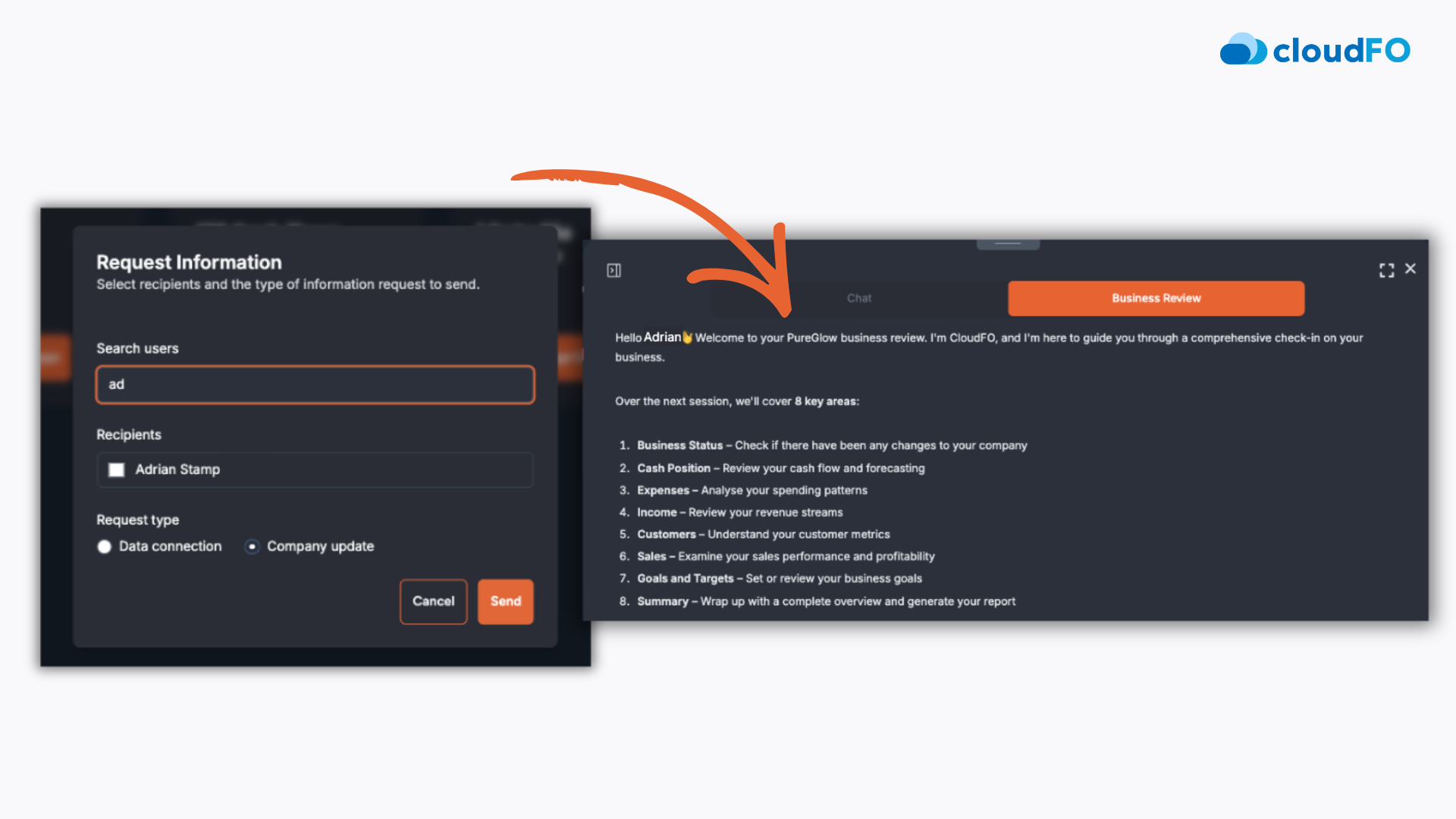

CloudFO’s Business Review lets clients quickly provide updates on hiring, pricing, projects, risks, and plans, the critical context accountants normally chase across emails and meetings.

3. Forecasting is extremely manual, especially when locking multiple spreadsheets

For many businesses, building a forecast takes 12+ days internally. When outsourced, firms often charge £1,000+ per day because the work is so time-consuming.

Finance managers echoed the pain:

“Forecasting only becomes manageable once you’ve built complex models and keeping them updated is the real job.”

Accounting firms & advisors face an added layer of difficulty:

- Every client needs a different model

- Spreadsheets break easily

- Scenarios require copying tabs and reworking assumptions

- Models aren’t standardised across the clients

- May need to hire staff with FP&A skills

This is why forecasting doesn’t scale for most firms, even though demand is exploding. As a result, many firms only offer forecasting to a small subset of clients where the fees justify the manual effort.

CloudFO builds a rolling 12–24 month forecast automatically by learning the patterns in the client’s historical financial and operational data.

4. Explaining variances is even harder

One commenter joked:

“Predicting the future is one thing. Explaining the variances when the future decides to be stupid is harder.”

Another said:

“I make a forecast, VP wants a different number. Then I spend the year explaining why that wasn't achievable.”

Accountants know this pain well: This is why many firms say forecasting is “only worth doing” for top-tier clients.

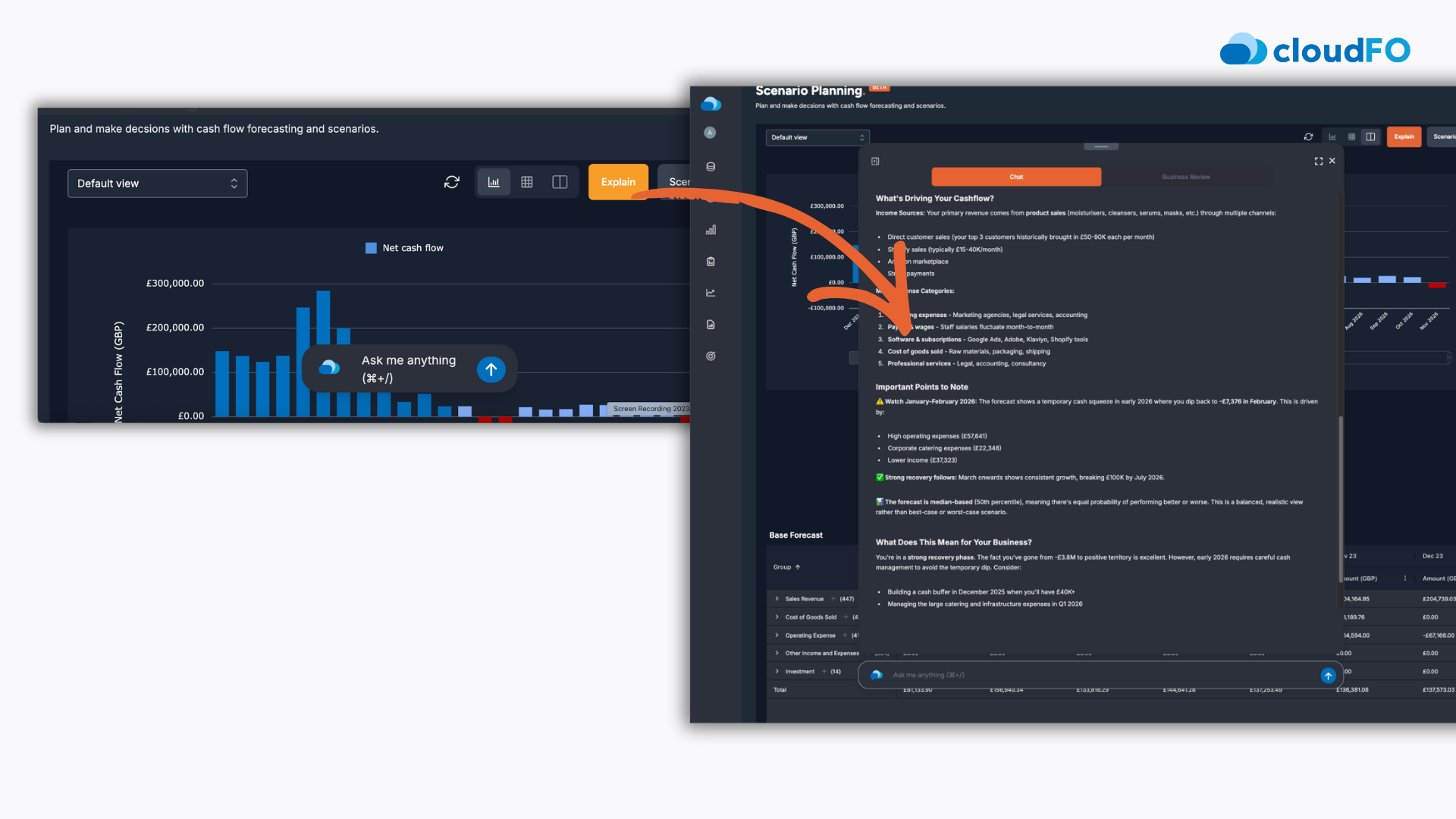

With one click, CloudFO breaks down:

- How the forecast was constructed

- The patterns behind the numbers

- Emerging risks and opportunities

- What changed versus the last period

- What to discuss with the client

CloudFO lets advisors provide CFO-level explanations without hours of prep.

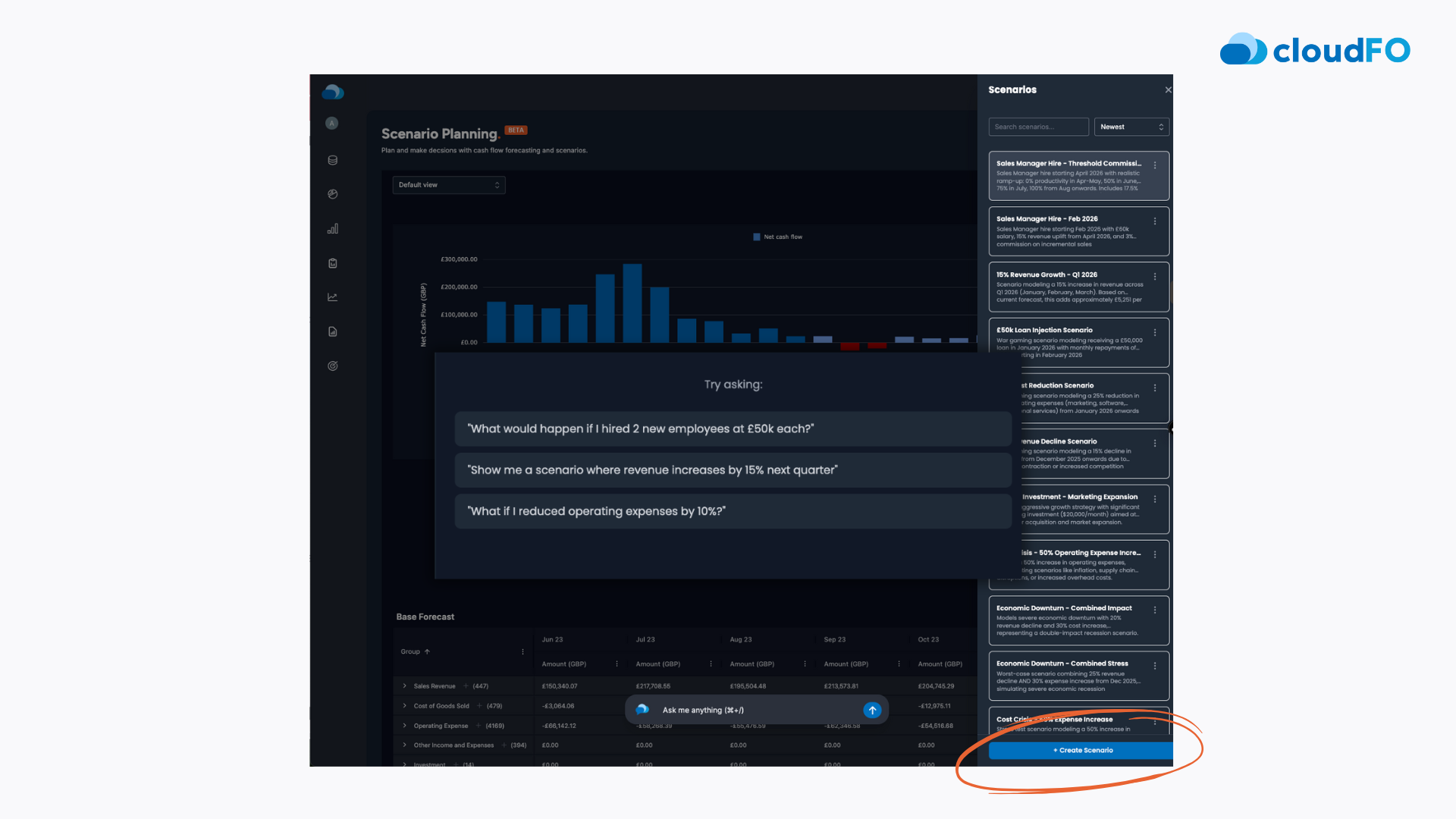

5. Scenario planning is nearly impossible to scale manually

Commenters pointed out that:

"The hardest part is making a model you can adjust logically without breaking everything.”

Yet clients continually ask:

- What if I hire two more people?

- What if sales drop 10%?

- What if we increase prices?

- What if we open a new location?

Scenario modelling is one of the most valuable advisory services, but also the most time-consuming.

How modern CAS firms solve this

CloudFO models the financial impact instantly and highlights differences from the base case, ready for client conversations.

6. Keeping forecasts updated and on-track is a persistent challenge

Even once a forecast is built, keeping it alive is where most teams struggle. A widely shared perspective puts it simply:

“Predicting is hard, but explaining why things have changed is often harder.”

Budgets go stale within weeks. Actuals come in differently than planned. One-offs distort the picture. Revenue drivers shift. Costs spike unexpectedly. A Quora commentator summarised the challenge:

“Businesses change faster than the spreadsheet does.”

For in-house finance teams this is already difficult. For accountants supporting dozens of clients, it’s almost impossible to maintain:

- A fixed annual budget

- A rolling forecast that reflects real performance

- Timely variance explanations

- Updated assumptions

- Visibility into upcoming events or risks

This is why many firms produce one budget a year and avoid ongoing forecasting the maintenance burden doesn’t scale.

“Lock a budget version while CloudFO keeps the rolling forecast updated automatically.”

CloudFO removes the complexity by automatically updating the rolling 12–24 month forecast from real client data. Allowing firms to fix a version as an annual plan or budget for comparison, showing budget versus actual versus rolling forecast side by side, highlighting and explaining all variances instantly.

Accountants can walk into every client meeting with a live, accurate forward view without rebuilding models or chasing updates.

CloudFO turns forecasting into a continuous, scalable advisory process instead of a once-a-year spreadsheet exercise.

Ready to try? Book a demo @info@cloudfo.co