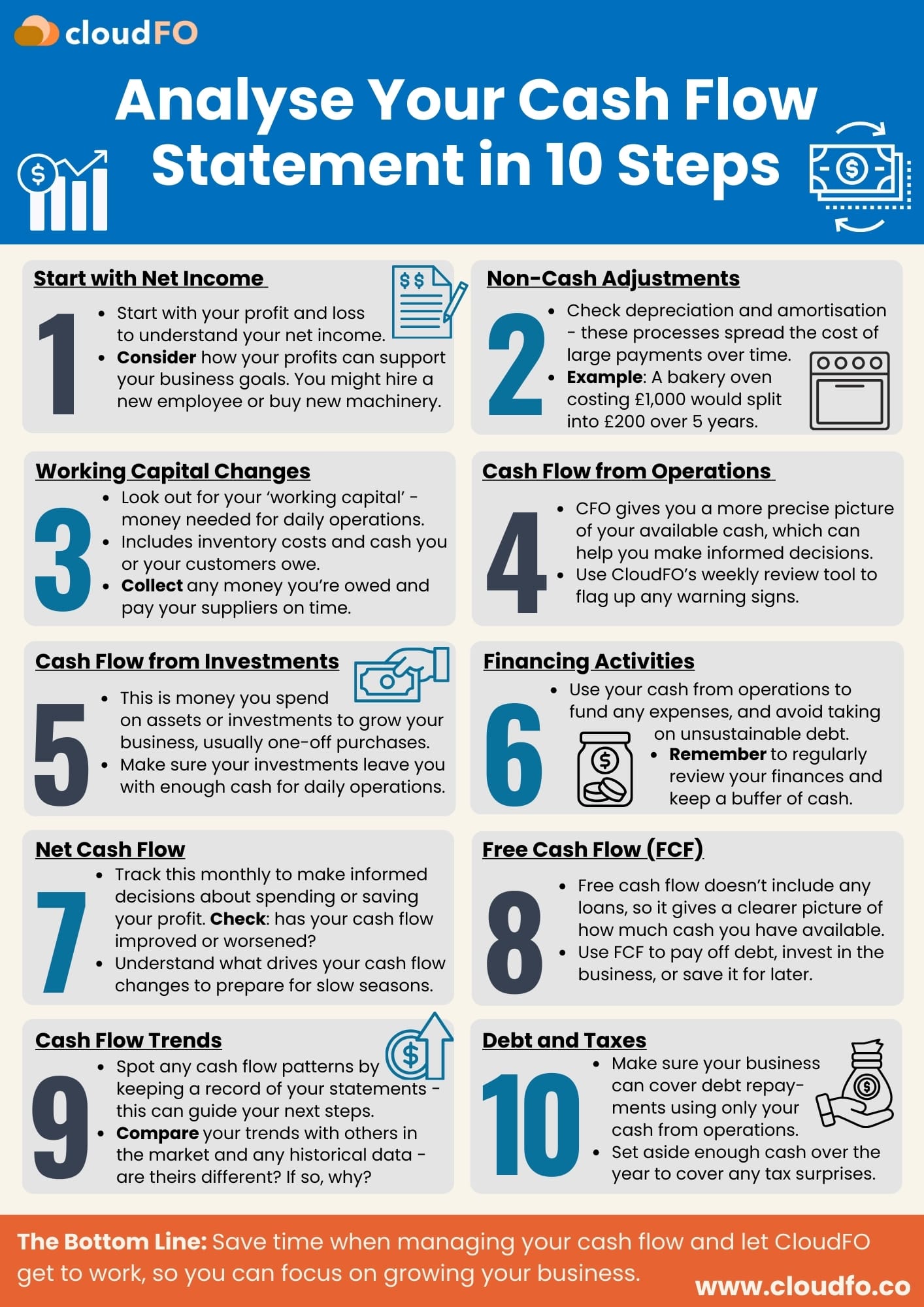

Cash Flow 101: How to Analyse a Cash Flow Statement in 10 Simple Steps

If you're a small business owner who struggles with the financial aspect of business management, you're far from alone! Managing your finances can often feel like a maze, and trying to understand the corporate terms used in accounting guides online is a sure-fire way to get a headache.

But if you’re looking to understand how your business works, your cash flow statements may be more useful than you think. They can provide valuable insights about how your business is running, and help you predict how your business will perform each month. They might direct you to save more for the upcoming slow seasons, or steer you towards investing in new machinery to drive production and sales.

By monitoring your cash flow, you can keep your finances flexible, grow your business sustainably, and withstand any financial storm. To help you out, we've created CloudFO's ten-step guide to deciphering any cash flow statement.

Step 1: Start with Net Income

Start with your profit and loss to understand where the cash flow statement begins. This is like a cash flow prequel - by looking at how your overall profit (or ‘net income’) is made, you can understand where your earnings come from, and whether they can keep your business afloat.

Why it matters: If your net income is positive, that’s great - your business is profitable and you’re making money! If it’s a low number, or in the negative, examining your margin helps you dig deeper into what might be going wrong.

Things to consider: Consider how your profits can support your goals for your business: do you need to hire another employee or invest in new filming equipment? CloudFO can use your income figures to suggest simple, actionable steps to boost your business growth and margins.

Step 2: Non-Cash Adjustments

The next section of the statement adjusts for non-cash costs, like depreciation and amortisation, which are included in net income calculation. These costs don't involve immediate cash but come from past big purchases over their lifetime.

How it works: Non-cash adjustments like depreciation spread the cost of a big purchase (like an industrial oven for a bakery) over its useful life, so the cost is matched to the income it helps generate over time.

Step 3: Working Capital Changes

Look out for changes in your working capital - this means any money you need to run your daily operations. This includes money owed to you by customers (or ‘accounts receivable’), inventory costs, and money you owe to suppliers (or ‘accounts payable’).

Why it matters: Pay your suppliers too quickly, and you risk losing cash that could be used more effectively elsewhere - for example, you might delay a payment by a few days to make an urgent debt repayment. But pay too slowly and you may damage your supplier relationships.

Make sure you collect the money customers owe you in a timely manner - the sooner you get your cash, the sooner you can reinvest it into the business to make more money.

If you have too much stock, it ties up cash that could be used elsewhere, so it might be a good idea to run promotions to move products faster. We recently wrote an article on inventory management methods to help small business owners: here.

Step 4: Cash Flow from Operating Activities

This figure is your net income after adjustments, and represents the total cash you made from business operations this period. Ideally, this amount should be enough to sustain your business after other expenses, and should be higher than your net income. This indicates that your business is financially stable.

Why it matters: This total gives you a more accurate picture of how much cash you have on hand, and can help you to make more informed financial decisions. You might then choose to save instead of reinvesting, if your adjusted net income is less than you expected.

Regularly checking your cash flow from operations helps you spot these issues early and tackle problems faster - and with CloudFO’s weekly review tool, your AI finance colleague can highlight any warning signs in your cash flow, giving you enough time to prepare a solution.

Step 5: Cash Flow from Investing Activities

This number covers the money you spend on assets and long-term investments, like new equipment or office space. These are usually large, one-time expenses that promote future growth for your business.

Things to consider: In this case, you would need to consider the long-term return on investment (ROI): is this purchase likely to pay off in the future? Is it necessary for the business? Investment can promote business growth, but if it’s straining your cash flow, you may need to cut back on spending.

Step 6: Financing Activities

This section shows how you’re funding your business, such as through loans or equity. Have a look at the amount of cash you receive from financing versus the amount you’re paying back. Make sure you can pay off any debt using only the cash your business makes - this shows that your business can sustain itself.

Why it matters: Staying aware of your financial situation can help you stay on top of your repayments. It’s tempting to bury your head in the sand, but staying up-to-date on your position can help you create a just-in-case fund for any unexpected payments.

Step 7: Net Cash Flow

This number is usually last on the statement, and shows the total change in your cash flow over the period. It includes cash flow from all your business activities, such as operations, investments, and loans. This figure can tell you whether your cash position has improved or worsened since the previous statement.

Why it matters: This can help you decide how to divide up your leftover cash - perhaps you finally have enough money to invest in fabric for that new clothing line. Or maybe your business isn’t as financially secure as you might like, so you need to build up your savings and create a buffer for emergencies and unexpected expenses.

Step 8: Free Cash Flow

Free cash flow is slightly different from net cash flow. This is because while net cash flow includes any money gained from loans or financing, free cash flow does not. That change helps you see how much cash is actually available after focusing on key business activities. It can be used to pay off debt, reinvest into the business, or save for later.

How it works: To find your free cash flow, simply take your net cash from operations minus any money you spend on assets and investments (or ‘capital expenditures’). If you need a refresher, see steps 4 and 5.

Step 9: Cash Flow Trends

This section requires you to track your cash flow over several periods. The aim here is to spot patterns or trends, which can help you make informed decisions about where you allocate your money. You can also use your findings to check that your business is not spending more money than it can make.

Things to consider: Compare your cash flow trends with other businesses in the market and any historical data. If your cash flow patterns are different to theirs, examine why - are you growing faster, or are there areas of your business that need improving? This financial check-up can keep your business healthy by catching any problems as they happen.

Step 10: Debt and Taxes

Finally, make sure your company can cover debt repayments using only the cash it makes from operations, and set aside enough cash during the year to cover taxes.

Why it matters: This step ensures your business is financially healthy enough to support itself, instead of falling deeper into debt to cover your costs. Planning in advance will help you avoid a frantic scramble to pay off any end-of-year tax surprises.

How Can CloudFO Help My Cash Flow?

Cash flow statements may seem daunting at first, but with this simple guide, you’ll be able to easily break them down, using the valuable information to support and grow your business.

While this guide does provide you with a solid foundation for understanding your statements, manually processing your cash flow can still feel overwhelming, leaving you weighed down by all the data, and losing sight of what really matters - growing your business.

So why not try CloudFO to easily manage and analyse your finances? Your AI finance colleague guides you through your business analytics, explaining concepts clearly and concisely so you can learn as you go.

Let CloudFO run the numbers, and take the stress out of financial management while you run your business. Our weekly review function provides you with actionable, helpful tips to optimise your cash flow, exclusively tailored to you. And with our 6-Week Business Boost course now recruiting, it’s the perfect time for you to try CloudFO, so you can see first-hand how it can level up your business.

Connect with small business owners in the comment section below, or via our socials! We’d love to hear your experiences or any of your questions about cash flow management.

Want the key takeaways all in one place?

Subscribe below to unlock an exclusive visual summary that simplifies this article into an easy-to-follow guide!

Before you go, check out these related articles:

Inventory Management Methods: https://blog.cloudfo.co/inventory-management/

The Power of Period-on-Period Reporting: https://blog.cloudfo.co/period-on-period-reporting/