Improve Your Profit Margins With These Five Tips

For your small business, a healthy profit margin could be the difference between sinking in a financial storm this year or surviving unscathed. Keeping your profits high also gives you the freedom to spend your cash where you choose, without worrying about staying afloat.

This is especially important in eCommerce, where sales happen at light speed and you have to make quick choices. A healthy profit margin creates a buffer, which can insulate you from the impact of interest increases, bad decisions, or financial instability. That’s why, in this blog post, we’ll look at simple, actionable steps you can take to improve your profit margins.

What Is A Profit Margin And How Do I Find It?

A profit margin is a way of measuring your business’s financial health. It is shown as a percentage and represents how much profit you make from every pound (or dollar) you earn.

Gross profit, which comes from your revenue minus cost of goods sold (COGS), shows how efficiently your company produces its goods. Note that if you’re returning a low gross profit, your business could be at risk of losing money.

Net profit represents your revenue minus all other expenses. It shows that your business is still profitable after all its expenses. This means you are free to use the net profit to pay debts, reinvest or save.

CloudFO does the hard work and calculates Gross profit and Net Profit for your view instantly in your CloudFO Dashboard

So, how do you calculate a profit margin? you’ll be pleased to know that you don't have to. CloudFO (your AI finance colleague) regularly runs the numbers on both gross and net profit for you.

Example: Let’s say a small online business sells £1,000 worth of stock over the course of a month.

Gross Profit

The business’s cost of goods sold (COGS) is £400.

To calculate gross profit:

Gross Profit = Revenue - COGS

Gross Profit = £1,000 - £400 = £600

Gross Profit Margin = (600 / 1000) × 100 = 60%

Net Profit

After calculating gross profit, we subtract other operating expenses (like rent, utilities, wages, etc.), say £300.

To calculate net profit:

Net Profit = Gross Profit - Operating Expenses

Net Profit = £600 - £300 = £300

Net Profit Margin = (300 / 1000) × 100 = 30%

Read our more detailed article about Gross and Net Profit here

Tip 1: Rework Your Pricing Strategy

Your pricing strategy impacts both your Gross and Net Profit, so it's important to find a balance that works for your business. Offering discounts on seasonal items like winter apparel or holiday cards can help clear stock and attract new customers, but be careful with deep discounts as they can lower your margins. Use them strategically to avoid hurting your profitability.

Raising prices on popular products, like a best-selling candle, may improve margins if demand is steady. Some products have more pricing elasticity, meaning a small increase might not drive away customers. Test gradual price changes to gauge customer response without risking sales.

Also, consider the perceived value of your product. If your offerings stand out for quality or uniqueness, customers may be willing to pay a bit more. Emphasising these value points, like the natural ingredients in organic skincare, can justify a higher price, as long as it aligns with customer expectations.

Tip 2: Reduce Your Operating Expenses & Cost of Goods Sold

To improve your gross margin, closely monitor your Cost of Goods Sold (COGS), as it directly affects your gross profit. Look for ways to reduce production or procurement costs without sacrificing quality. For example, explore alternative suppliers or negotiate better terms with your current ones. Even small savings can have a big impact on your margins, especially if they’re already tight.

When it comes to operating expenses like marketing, rent, and utilities, streamlining processes can boost your net profit margin. Automating repetitive tasks or outsourcing non-core activities can save both time and money. Tools like CloudFO automate the management of your business's finances. Not only does it help you stay on top of your margins, but it also makes the process quick and easy, ultimately reducing overheads and stress while freeing up resources for growth.

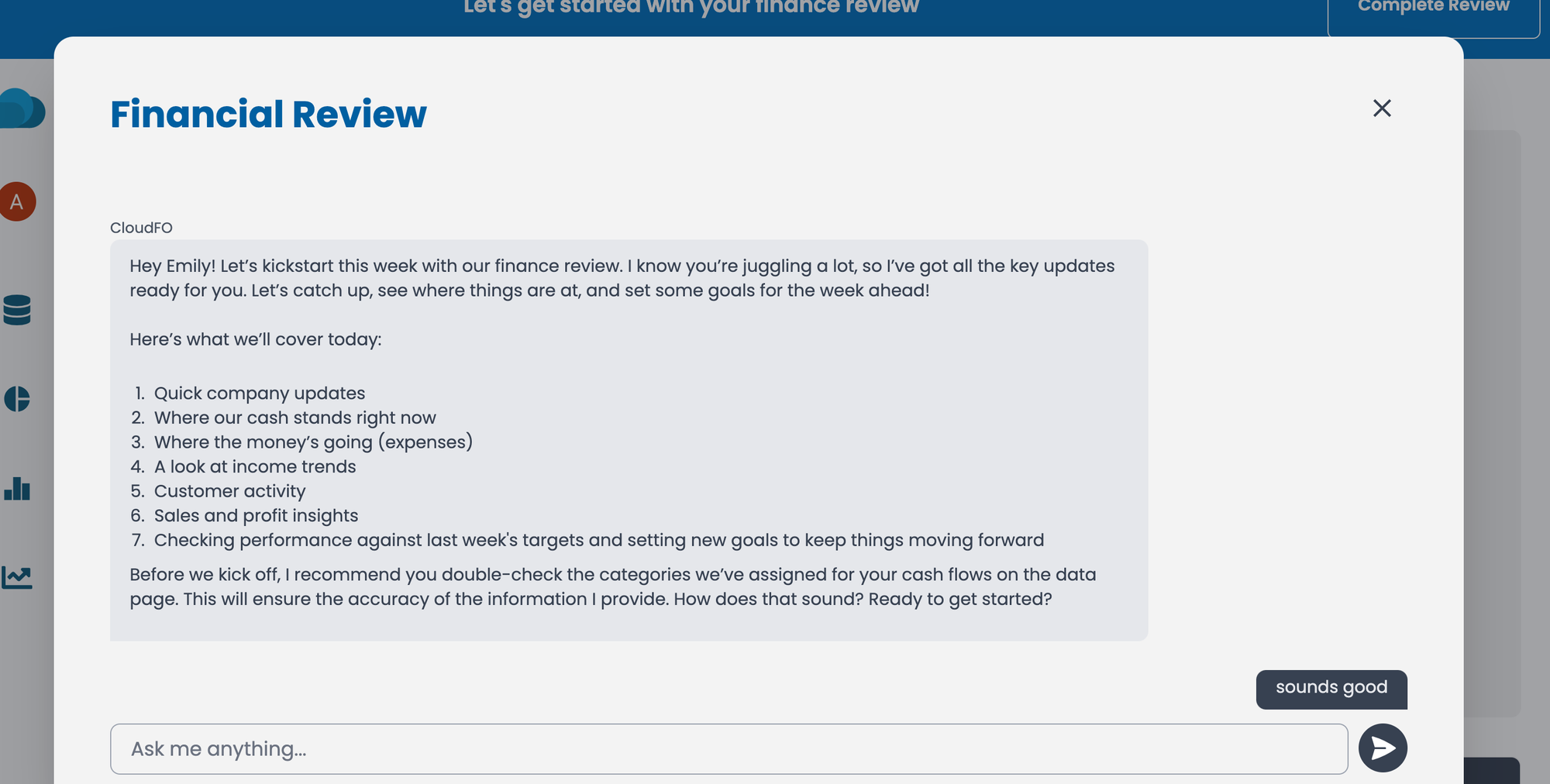

Regularly reviewing your spending is important. If your margins are shrinking, it may indicate that your expenses need adjusting. For example, rising raw material costs or labour should be factored into your pricing strategy. By staying on top of both COGS and operating expenses, you can make informed decisions that protect your profitability. Your coworker CloudFO runs a weekly business finance review meeting to break down your spending analysis to help you keep things on track.

Tip 3: Increase Your Average Order Value

Help your existing customers increase how much they spend with you each time they shop. One method involves offering bundles: products grouped together and sold at a lower price to increase their perceived value. This makes customers more likely to pay extra if they realise the product is higher value for money.

A different method of increasing your order values is to introduce ‘upselling’ and ‘cross-selling’ to your website. Upselling involves offering customers a higher-value version of the item they’re already buying, whereas cross-selling involves offering customers a complementary product to the one they’re buying.

For example, let’s say a customer at an online apparel store is buying a jumper from a set of loungewear. An upsell would offer a similar but higher-value version of that jumper, whereas a cross-sell might encourage the customer to buy the matching pair of shorts from the set.

Read more about average order value here

Tip 4: Improve Your Inventory Management

The benefits of good inventory management methods include reduced excess stock, lower storage costs, and more cash on hand. All of these combined can reduce the strain on your cash flow and boost your profit margin.

Our article on inventory management methods on the CloudFO blog provides a detailed overview of each approach, along with an exclusive flowchart quiz to help you determine which method is best for your business.

Read more on how to level up your inventory management here

Tip 5: Increase Customer Retention

It’s important to focus on building loyalty with your customers since retaining them can be cheaper than trying to attract new customers through your marketing or branding efforts.

Consider creating loyalty programmes or special offers that reward your customers for repeat purchases. An online bookstore might have a rewards programme that lets customers get 20% off on their next order after ten purchases. This helps to build stronger relationships with the customers as well.

How Can CloudFO Help?

There are so many ways to boost your profit margins as a small business, from optimising your prices to improving your inventory management. Each of the tips we’ve outlined in this blog post can help you significantly improve your profit margin, as well as your overall financial health.

But carrying out each step manually can be a real struggle, leaving you with barely any time to do what you love – designing, creating, and selling.

The solution? CloudFO. Your AI finance colleague can help you keep track of your profits in real time, providing accessible analytics and answers to your questions with simple, easy-to-understand language. CloudFO does the math for you, returning regular updates on your net and gross profit margins, as well as many other KPIs.

Our weekly finance reviews provide you with personalised tips and tricks on how to improve your financial health, along with clear, targeted reports on your company’s finances to keep you informed. And that’s not all – CloudFO is designed to effortlessly connect to your Shopify storefront, giving you personalised, up-to-date suggestions on growing your business.

Ready to take the next step? Sign up to CloudFO