Mastering Your Business Finances: Gross Profit vs. Net Profit Explained

As a business owner, your passion fuels your vision and drives what you bring to the world. However, understanding the financial heartbeat of your business is just as important as creating your designs, services, or content. Let's be honest—finance can often be filled with jargon, making it difficult to navigate. So, let's break it down and clarify the concepts of Gross Profit, Net Profit, and their margins. Grasping these essential metrics can unlock new opportunities and empower you to take your brand to new heights.

What is Gross Profit?

The Heartbeat of Sales

Gross Profit is the lifeblood of your business—it shows how much you earn from sales after covering the direct costs of producing your goods or services. Imagine you’ve just sold a batch of those amazing handmade candles you’ve worked so hard to perfect. Gross Profit answers the crucial question: how much are you actually making from each sale?

The Calculation

Let’s say you sold £700 worth of candles, but it cost you £400 to make them (that’s your Cost of Goods Sold, or COGS).

Your Gross Profit would be £300.

The formula is simple: Gross Profit = Sales Revenue − COGS

Why It's Important

Tracking your Gross Profit is crucial because it reveals how well you're managing production costs and pricing. A healthy Gross Profit indicates that your core business operations are running smoothly. If your Gross Profit starts to decline, it’s a clear sign that you may need to reassess your pricing or production processes.

What is Gross Profit Margin?

Your Efficiency Indicator

Gross Profit Margin puts your Gross Profit into perspective by showing what percentage of your revenue is profit. This is crucial for assessing your business's efficiency. A high Gross Profit Margin means you’re retaining more of your sales revenue as profit, which is great news for your bottom line!

The Calculation

Gross Profit Margin = (Gross Profit/Sales Revenue)×100

Why It's Important

A higher Gross Profit Margin indicates that you're managing your costs effectively and pricing your products correctly. This means more money to invest in marketing, product development, or even that new website you’ve been dreaming of. It’s also a great metric to impress potential investors or partners, showcasing how efficiently your brand operates.

What is Net Profit?

The Bottom Line

Now, let’s take it a step further with Net Profit. This figure represents what remains after you've subtracted all your operating expenses and other costs from your total income. Net Profit is the ultimate measure of your business's profitability and your ability to thrive.

The Calculation

Imagine you run a social media strategy agency. Over the course of the year, you secure several lucrative contracts, generating a total income of £150,000 from your services. However, you also incur expenses associated with running your business, including the cost of goods sold, software subscriptions, salaries for your team, office rent, marketing costs, and other operational expenses, which total £120,000. As a result, your Net Profit would be £30,000. It's important to note that COGS is included here to provide a complete picture of your profit.

Net Profit = Total Income − Total Expenses

Alternatively, you can express it as:

Net Profit = Gross Profit − Operating Expenses

Why it's Important

Net Profit is the true measure of your business's gain. It reflects how well you're managing not just your production costs but your overall expenses. Consistently positive Net Profit signals a healthy and sustainable business, while negative Net Profit may prompt a reevaluation of your strategy. This figure allows you to plan for the future—whether it’s expanding your product line or opening a new store!

What is Net Profit Margin?

Net Profit Margin is the percentage of revenue that remains as profit after all expenses have been accounted for. It provides a comprehensive view of a company's profitability in relation to its total income.

The Calculation

Net Profit Margin = (Net Profit / Total Income) ×100

Why It’s Important

Monitoring Net Profit Margin enables businesses to evaluate their overall financial health. It helps identify how effectively a company manages its expenses and generates profit. A higher Net Profit Margin indicates greater efficiency, suggesting that a larger percentage of revenue is retained as profit.

How Gross and Net Profit Work Together

Understanding Gross and Net Profit is essential for any business owner. Gross Profit indicates how well you’re producing and selling your products or services, while Net Profit reveals your overall financial health after accounting for all expenses. If your Gross Profit is high but your Net Profit is low, it may suggest that your operating costs are eating into your profits, signalling the need to identify areas for cost reduction. Conversely, a low Gross Profit paired with a high Net Profit means that while your sales might not be highly profitable upfront, you’re effectively managing your costs, keeping you in the black. The key is to find the right balance—by boosting both your Gross and Net Profits, you can set your business up for sustainable growth and success.

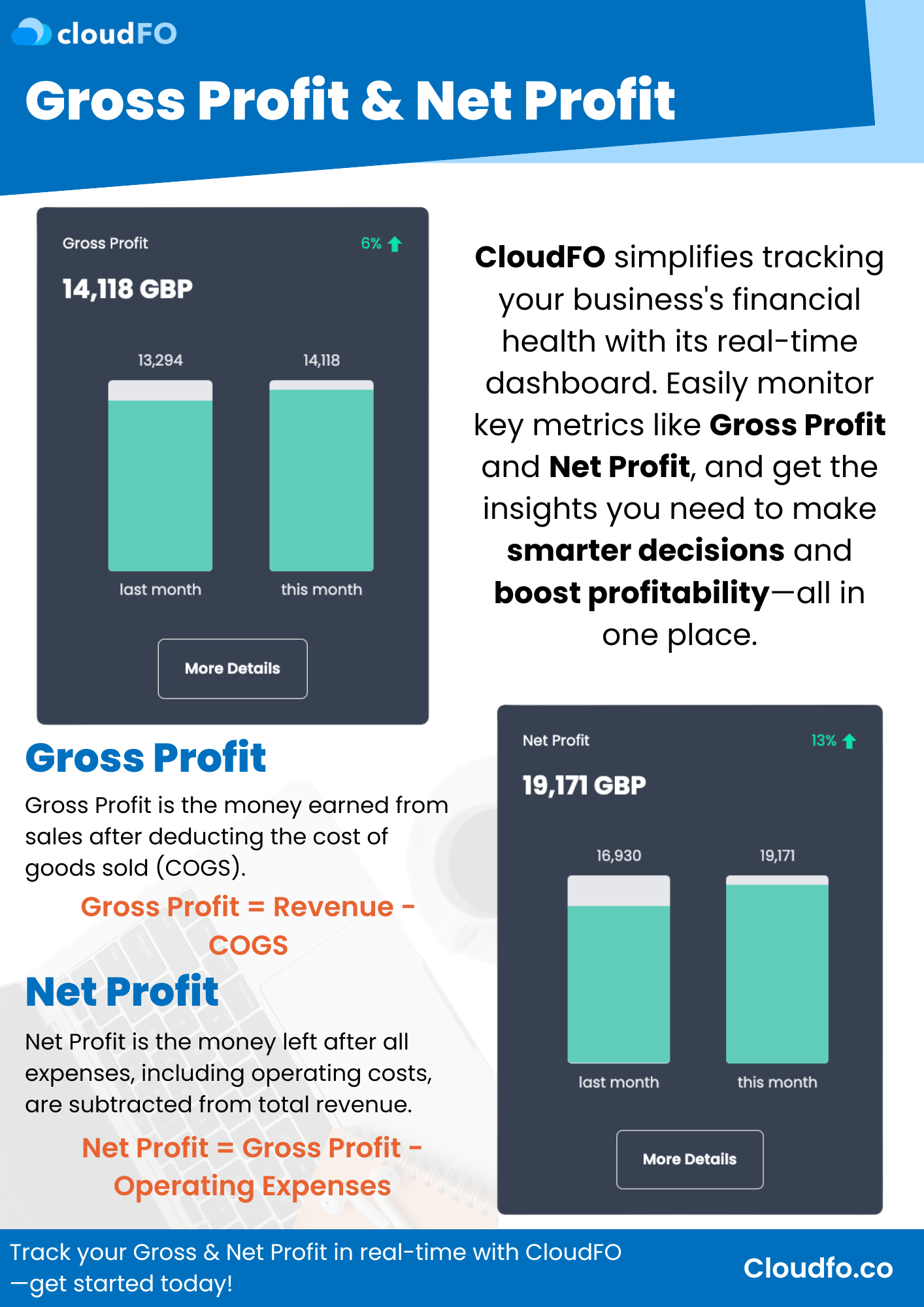

Unlock Your Business Potential with CloudFO

CloudFO tracks and monitors your Gross Profit, Gross Profit Margin, Net Profit, and Net Profit Margin for you—allowing you to view these key performance indicators (KPIs) directly in your CloudFO dashboard. Each Monday, during your weekly finance review, CloudFO dives deep into the numbers, revealing what’s driving your margins and offering tailored strategies to enhance your profitability. However, you don’t have to wait for Monday; you can chat with CloudFO anytime to discuss your margins and discover opportunities for improvement. Let us empower you to make informed financial decisions and unlock your business's true potential!

Subscribe below to see how CloudFO makes real-time tracking of your key metrics effortless—boost your profits and make smarter decisions!