How Accounting Firms Deliver Advisory Services and Where Most Get Stuck

Accounting firms across the UK are facing the same structural pressures.

Traditional compliance work is increasingly commoditised. Technology has flattened fees. Clients view statutory accounts and tax as very necessary, but not value-adding, pushing those services into price-led conversations rather than relationship-led ones.

At the same time, client expectations have shifted. Business owners increasingly want forward-looking insight, visibility, and support with decisions, not just historical reporting.

Most firms recognise this. Many already offer elements of advisory. Yet far fewer have managed to turn advisory into a repeatable, scalable way of working with clients.

To understand why, it helps to look at how firms actually deliver advisory in practice.

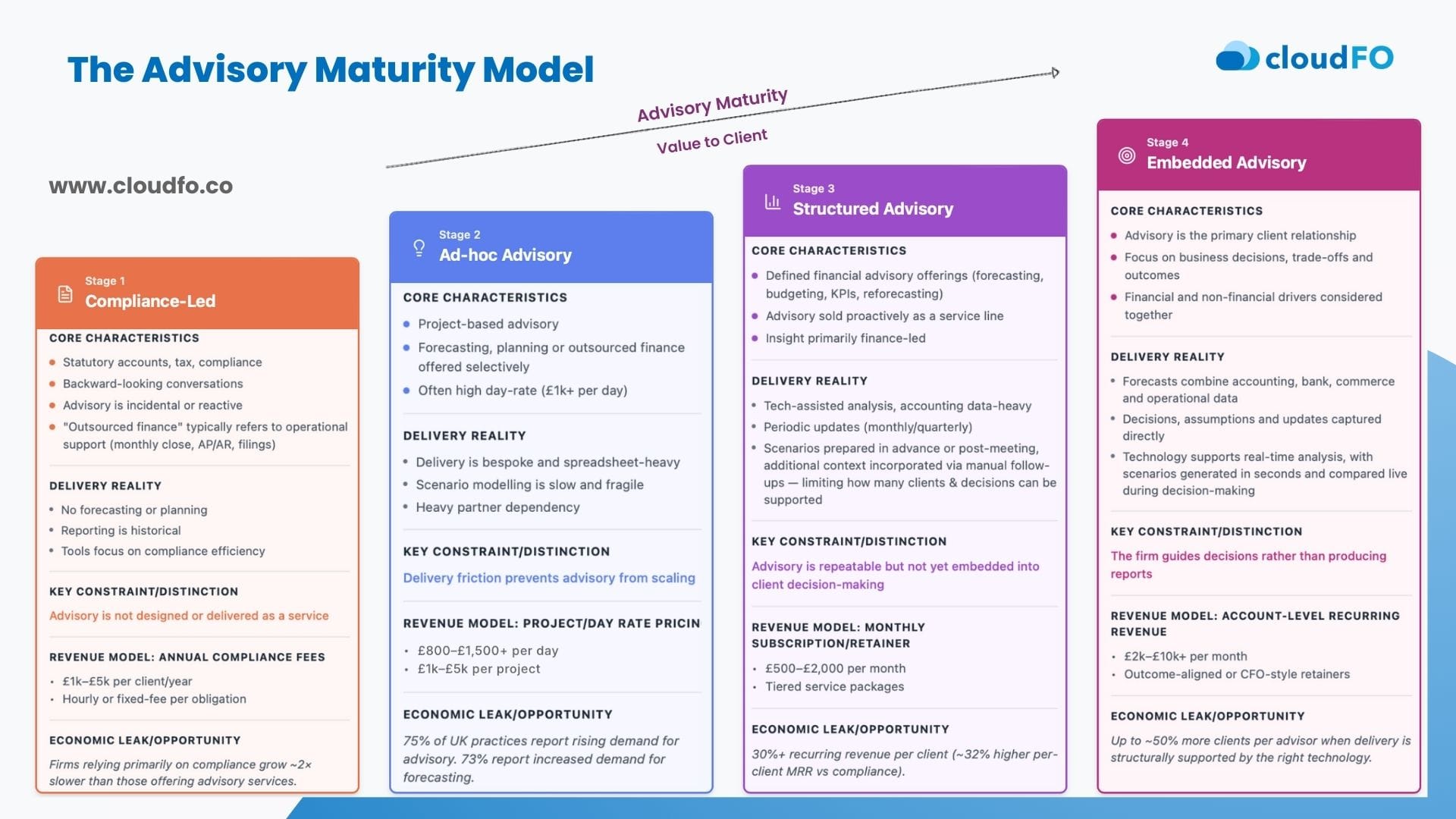

A Four-Stage View of Advisory Delivery Maturity

The model below doesn’t describe ambition, quality, or technical competence.

It describes how advisory services are designed, delivered, and commercialised day to day.

Firms can offer forecasting and still sit early on this scale. What changes across stages is not what firms want to do, but how advisory is supported operationally and commercially.

Where Most Firms Get Stuck

Most firms don’t get stuck because they lack ambition or intent. They get stuck because the way advisory is delivered creates friction.

At the compliance-led end, advisory has no natural home. Work is backwards-looking and obligation-driven, so even good conversations are hard to package, price, or repeat.

As firms begin offering advisory on an ad-hoc basis, value becomes clear. Clients will pay, but delivery is fragile. Forecasts start from scratch, scenarios take time to rebuild, and assumptions are buried. The work depends heavily on senior people, making advisory difficult to sell proactively or scale with confidence.

Structured advisory improves consistency, but effort often creeps back in. New decisions still require setup, and insights arrive periodically rather than when choices are being made. Many firms hover here, caught between structure and bespoke work.

Only when advisory becomes embedded does the model support the ambition. Forecasts stay live, assumptions are visible, and scenarios can be explored as questions arise. Advisory shifts from a project to an ongoing relationship.

This is why firms don’t get stuck moving from compliance to advisory. They get stuck moving from bespoke insight to repeatable decision support.

Why Skills and Client Relationships Develop Together

Advisory is difficult to scale because skills and client understanding don’t develop through training alone.

As CPA.com notes, advisory capability grows through repeated, relationship-led work, understanding how a client’s business operates and how decisions are actually made.

That depth is hard to build through one-off projects. Context is lost, learning doesn’t compound, and relationships remain concentrated with a few senior people. Even technically strong professionals can lack confidence when assumptions are hard to explain and conversations feel high-risk.

When delivery is continuous and structured, that changes. Regular conversations build commercial understanding. Assumptions become clearer. More people can contribute meaningfully.

The challenge, then, isn’t just developing advisory skills; it's creating a delivery environment where those skills and relationships can grow over time.

How Technology Supports Both Delivery and Skills Development

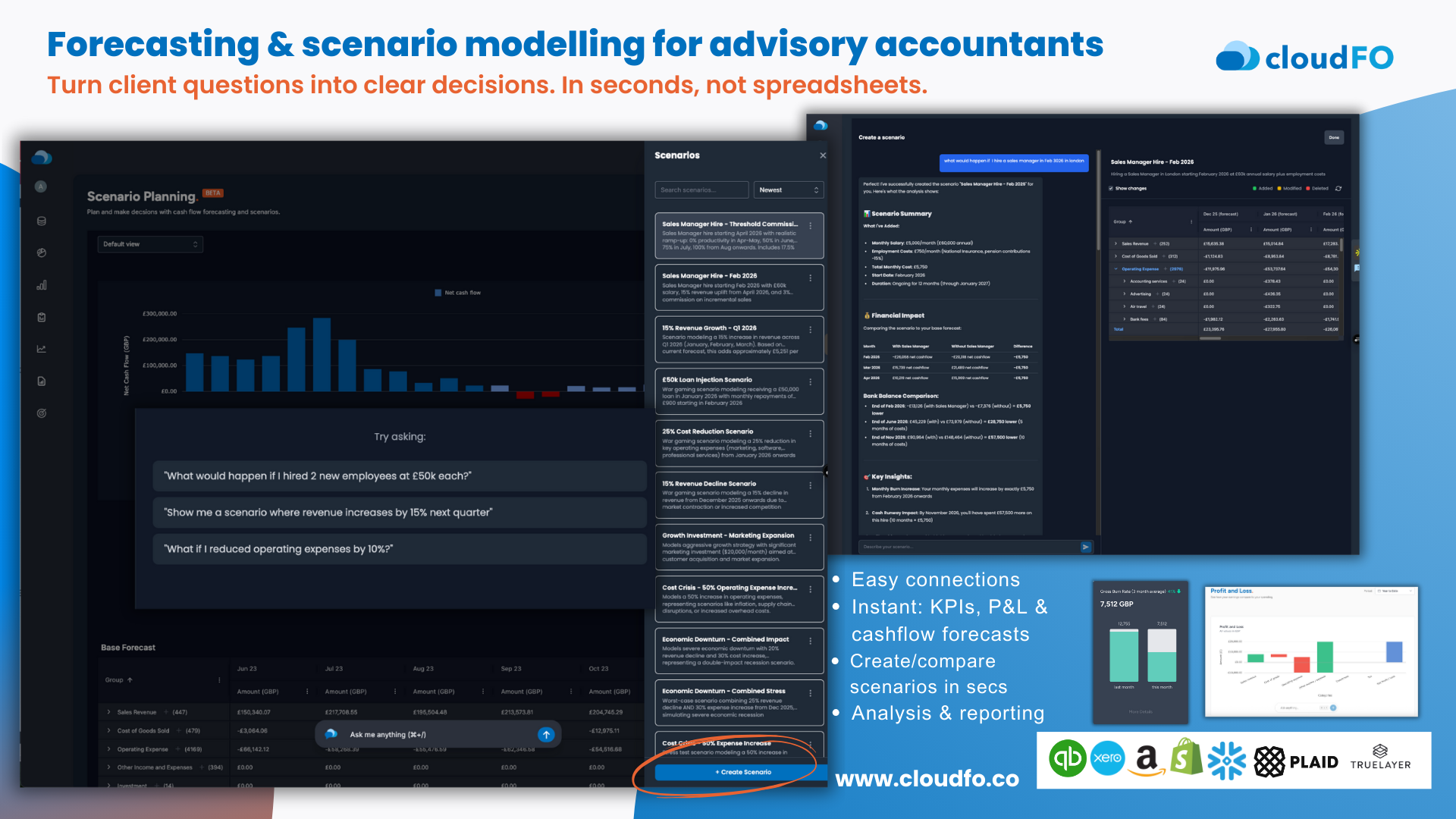

This is where platforms like CloudFO play a critical role.

CloudFO doesn’t replace judgment, expertise, or relationships. It reduces the delivery friction that makes advisory hard to learn, hard to repeat, and hard to scale.

By:

- Starting every engagement from a live baseline forecast

- Surfacing assumptions in plain language

- Generating and comparing scenarios in seconds

- Explaining outcomes visually and clearly

CloudFO creates a safer, more structured environment for advisory conversations.

That matters because:

- Skills develop through repetition, not one-off projects

- Confidence grows when outcomes are explainable

- Advisory improves when the focus shifts from building models to interpreting the impact they describe

For firms earlier on the curve, CloudFO helps professionals upskill through use, rather than requiring months of abstract training before advisory can be sold.

The Takeaway

Client demand for advisory is real. Skills development is a real challenge. But the biggest blocker remains how advisory is delivered.

When advisory relies on bespoke spreadsheets and manual effort:

- Skills are harder to build

- Confidence is harder to maintain

- Advisory remains high-value but high-risk

Firms that redesign delivery, using technology as an intermediary, create an environment where:

- Advisory skills develop faster

- Conversations become more consistent

- Forward-looking support becomes part of everyday client relationships

That is the shift CPA describes and the gap CloudFO is designed to close