What is Cash Runway?

As we demo and speak with new customers of CloudFO, we always ask them how it feels to see how long they have till they run out of money?

Running out of funds is one of the main reasons businesses fail (82%) so cash runway is a useful financial metric or KPI for business owners and leaders to estimate the amount of time they have before they run out of cash. in order for proactive actions to be taken to prevent it. It is important to understand and manage your cash runway to help ensure the long-term success of your business.

What is a Cash Runway?

Cash runway is how long your business can continue to operate before it runs out of cash. It is the amount of time your business has before it must increase income, raise more capital or face the risk of running out of money. It’s a measure of time you have as a business before needing to secure additional funding

Why cash runway matters

Seeing your cash runway there in bold might make you gulp - but having a view of where you are helps you plan for the future.

Understanding your cash runway provides a valuable perspective on financial planning and funding strategies. Different funding sources, such as loans, lines of credit, investments, grants, and crowdsourcing, come with varying timelines for acquisition. For example, if your cash runway is set at 6 months, and you anticipate that a crowdsourcing round will take approximately 3 months to plan and execute, it's crucial to initiate the process within the month. Waiting longer could necessitate seeking alternative funding options to bridge potential gaps in your finances. This scenario is particularly relevant for early-stage companies that might have limited funding choices, making timely action imperative.

Moreover, cash runway serves as a critical gauge of your company's financial health, particularly concerning expenditures. It provides insight into whether your business is operating within its financial means or if adjustments are required to ensure long-term sustainability. Monitoring changes in cash runway over time is essential; if it diminishes from one period to the next, it could be a signal that your expenses are outpacing your income.

Cash runway is a delicate balance between growth and profitability. Startups often have a higher expense-to-income ratio, resulting in a relatively shorter cash runway compared to well-established companies. However, it can also reveal areas where you have room to strategically invest in the business for sustainable growth.

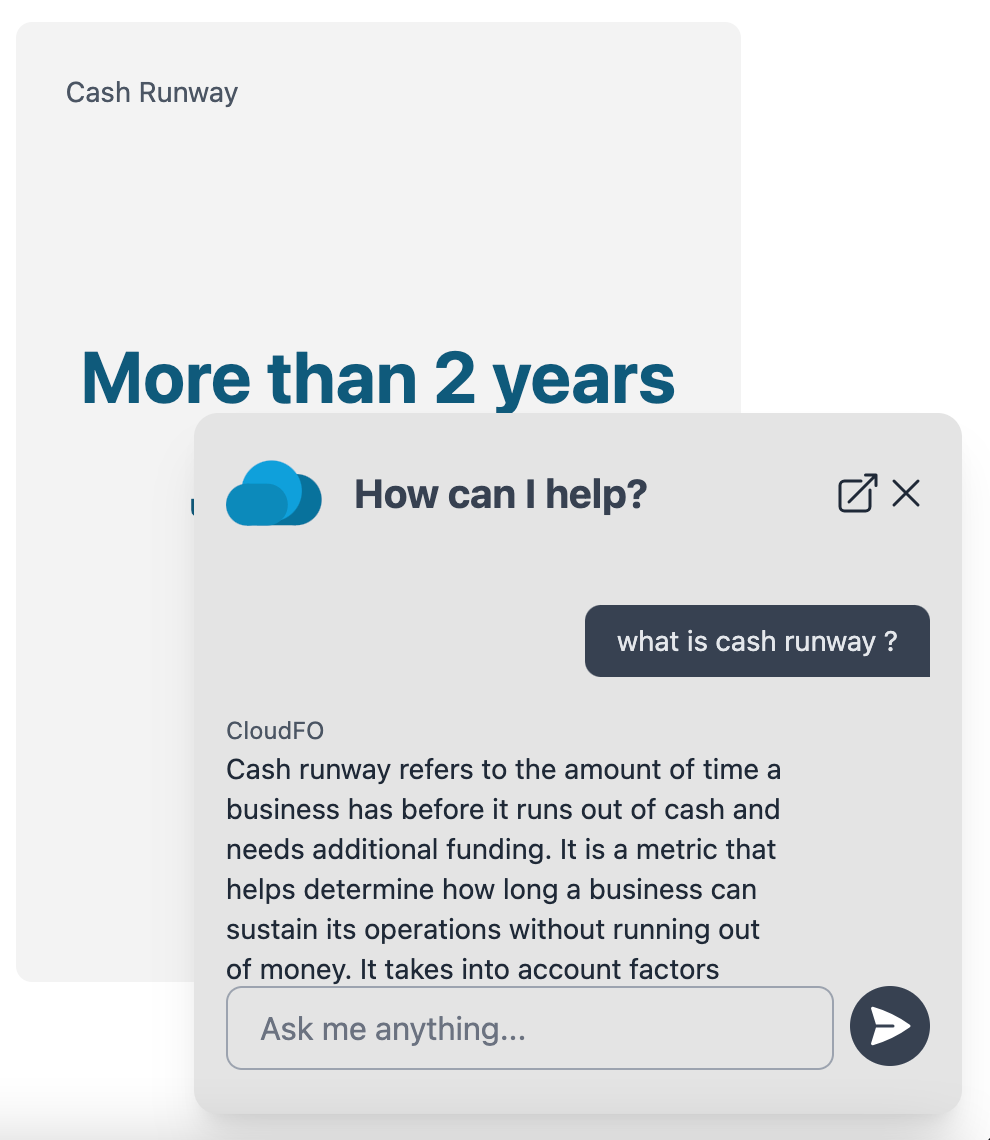

CloudFO cash runway

CloudFO streamlines the calculation and tracking of your cash runway. By seamlessly connecting your bank transactions through CloudFO's FCA-approved open banking connection (read-only) and integrating with other essential applications, the Cash Runway KPI is calculated from a near real-time, feed of your cash transactions. This live view of your cash runway provides invaluable insights into your financial standing.

Whether you're generating reports for internal use or presenting to investors and stakeholders, CloudFO ensures transparency and clarity regarding your business's current financial position.

Strategies for extending Cash runway

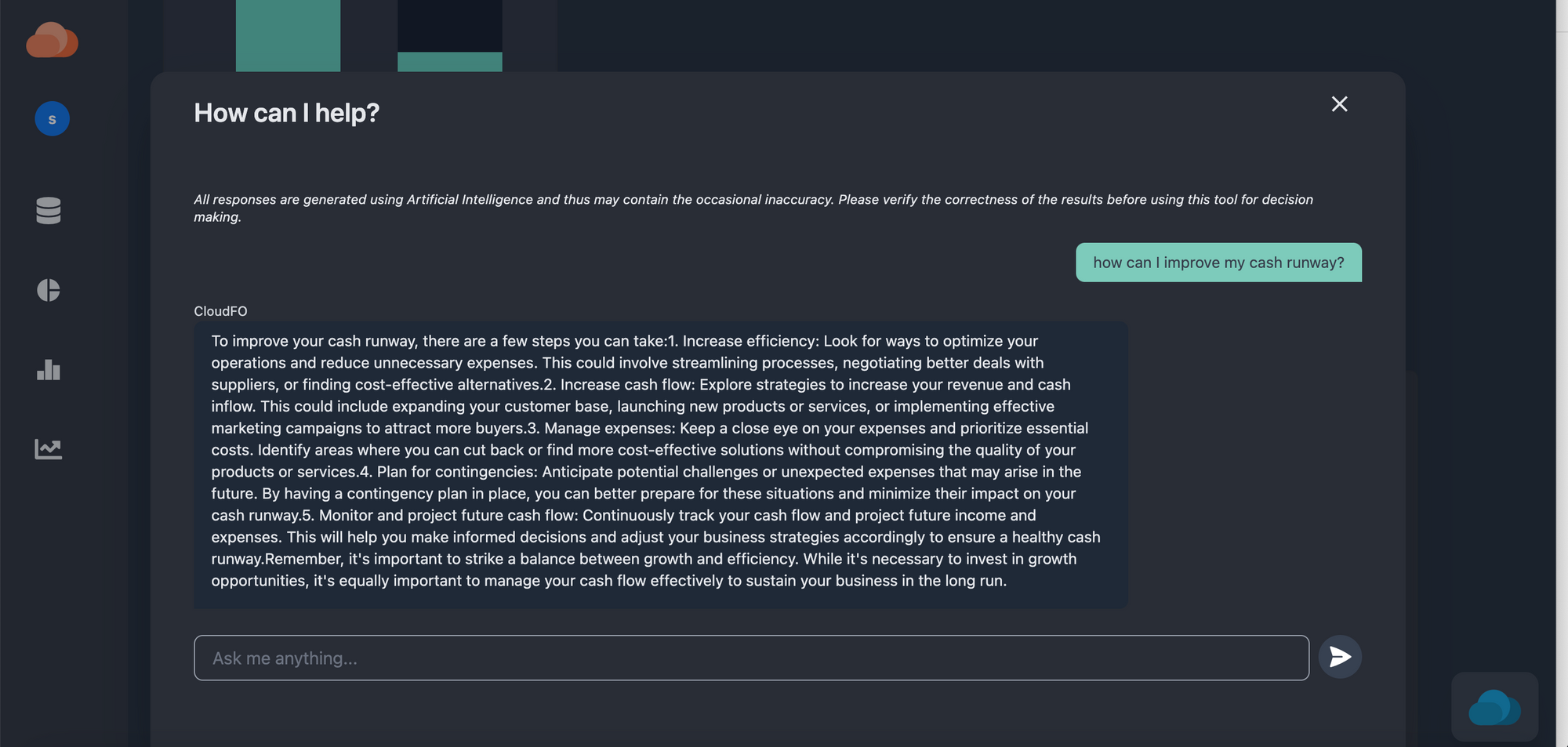

Sitting down with your AI Finance colleague to explore Strategies for Extending Your Cash Runway:

- Expense Review: Your first step should involve a comprehensive review of your expenses. You can easily perform this analysis using CloudFO's Expense KPI and the "Analyse Transaction" section.…or you can just ask CloudFO. Its worth prioritising reducing expenses by identifying areas where you can cut costs or streamline processes. This might also involve negotiating better deals with suppliers or finding more cost-effective alternatives.

- Increase Cash Flow: Explore strategies to boost your sales and overall income, consequently increasing cash inflow. Consider expanding your customer base, launching new products or services, or running effective marketing campaigns to acquire new customers. Keep in mind that some of these tactics might initially require additional spending, potentially impacting your cash runway negatively.

- Customer Retention: While acquiring new customers is essential, don't overlook the value of retaining existing ones. Loyal customers tend to provide a steady stream of revenue. Implement customer retention strategies to reduce customer churn.

- Accounts Receivable Management: To enhance your cash inflow, implementing effective accounts receivable management strategies can be instrumental. Focus on accelerating the collection of outstanding payments, which can help optimise your working capital. This entails staying on top of invoicing, following up on overdue payments, and improving your credit policies.

- Debt Restructuring: If you have outstanding loans or debts, you may want to explore options for debt restructuring or refinancing. This could involve negotiating better terms, consolidating debts, or seeking lower-interest financing options to reduce interest expenses.

Ready to see your Cash runway in bold - sign up today