Why Accounting Firms Are Moving Into Advisory Services. Whether They Plan to or Not

For some accounting firms, the move into advisory may not have started with a strategy day or a bold reinvention plan.

It started with a quiet shift in client behaviour.

Clients still need statutory accounts, tax returns, and compliance work. But increasingly, they treat those services as necessary for compliance but not valuable for business. Fees are questioned, comparisons are made, and conversations become price-led rather than relationship-led.

At the same time, a different kind of question is showing up more often.

No longer just “Can you file this?” But also “What should I do next?”

Compliance Has Become a Cost. Decisions Are Where Value Lives.

Technology has done exactly what it promised to do in compliance work.

Automation has improved accuracy, reduced manual effort, and standardised delivery. But it has also flattened differentiation. When every firm uses similar tools and processes, clients struggle to see meaningful differences and price becomes the deciding factor.

As a result, compliance has become:

- expected

- comparable

- and increasingly commoditised & automated

That doesn’t mean it isn’t important. It means it’s no longer where firms can sustainably create value.

Value now lives in helping clients make better decisions and building relationships.

Clients Don’t Want “Advisory”. They Want Clarity.

Most business owners don’t wake up asking for advisory services.

They ask questions like:

- “Can I afford to hire?”

- “Why does cash feel tight despite growth?”

- “What happens if revenue drops?”

- “Should I invest now or wait?”

These aren’t technical accounting questions. They’re planning, making trade-offs and asking decision questions.

And when accountants can’t help answer them, clients look elsewhere to fractional CFOs, consultants, or independent advisors. When it works well, these can all be partners.

This is why advisory isn’t an upsell. It’s a response to a gap clients already feel.

The Economic Case for Advisory Is Already Clear

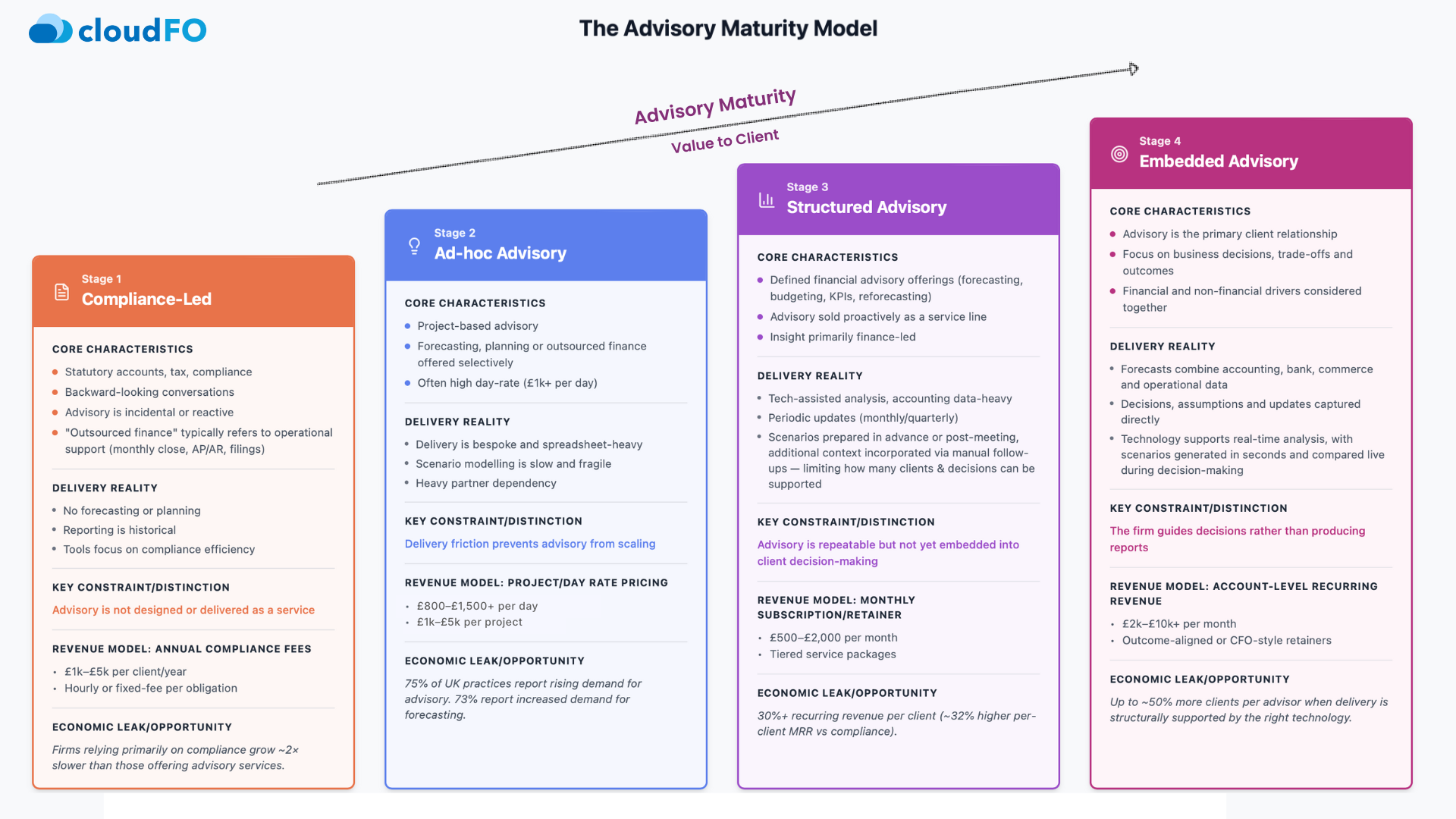

Where firms do deliver advisory effectively, the commercial outcomes are materially different.

Industry research consistently shows that firms offering structured, ongoing advisory services achieve:

- Higher revenue per client

- More predictable recurring income

- Stronger client retention

Because advisory aligns fees with ongoing value, not one-off outputs.

The shift from year-end work to year-round relationships changes a firm's economics.

Read more about the economics of the accounting firm advisory service delivery models

Talent Expectations Are Changing Too

The pressure isn’t only coming from clients.

Accounting professionals entering the industry or aiming for growth increasingly want roles that involve:

- Judgement

- Interpretation

- Influence

- Problem-solving

Purely transactional work struggles to attract and retain experienced professionals, on top of challenges attracting people into the profession. Advisory services provide clearer progression paths and intellectually rewarding work, but only if they can be delivered consistently.

Without that consistency, advisory becomes stressful rather than satisfying.

So, Why Hasn’t Everyone Made the Shift?

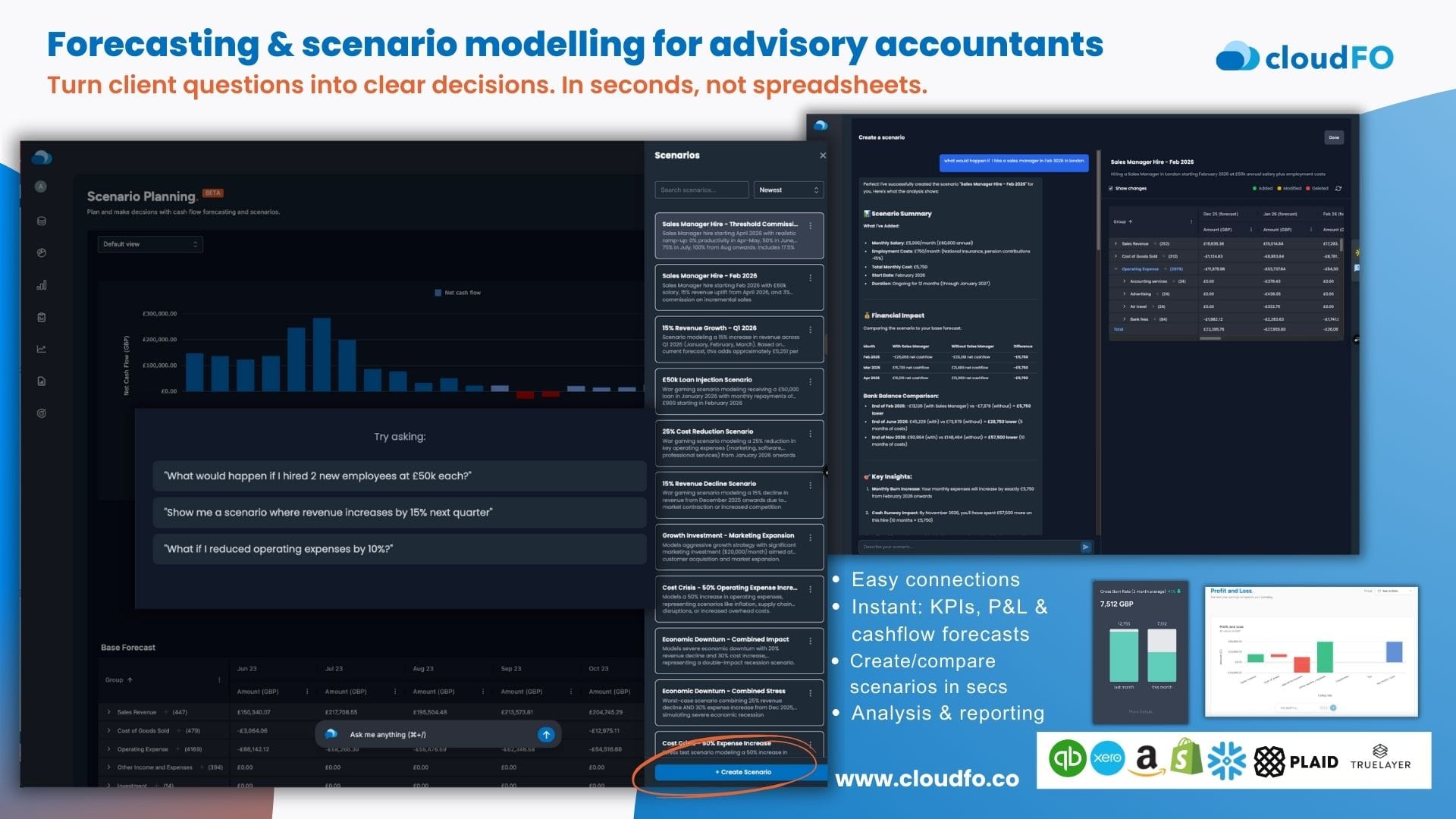

If client demand, economics, and talent all point in the same direction, why haven’t most firms fully moved into advisory?

Because wanting to do advisory and being able to deliver it reliably are not the same thing.

Many firms:

- Offer advisory reactively

- Struggle to scope and price it

- Rely on bespoke spreadsheets

- Worry about getting it wrong in front of clients

The intent is there. The delivery model often isn’t.

Advisory Isn’t a New Service. It’s a New Way of Working.

This is the critical distinction.

Advisory isn’t something firms “add on” to compliance. It’s a different way of engaging with clients, one that’s:

- Forward-looking

- Continuous

- Decision-led

That shift requires changes in:

- How services are packaged

- How conversations are structured

- How technology supports delivery

Firms sense this intuitively. Many are already experimenting. Few feel fully confident they’ve cracked it.

Advisory doesn’t fail on intent. It fails on delivery.

CloudFO helps firms deliver forward-looking, decision-led advisory consistently, so confidence, capability, and value compound over time.

What Comes Next

Understanding why advisory is becoming unavoidable is the first step.

The next post will answer the questions: How do firms actually deliver advisory in practice and why do so many get stuck trying to scale it? Follow the blog so you don’t miss it.