The Role of AI in Finance: What it Will Replace and the Resistance Ahead

AI is rapidly transforming finance and accounting, automating tasks once thought to require human manual effort and oversight. But while the technology is evolving at rapid pace, widespread adoption still faces organisational, regulatory, and cultural resistance.

At CloudFO, we are at the forefront of this shift, redefining how small and medium-sized businesses (SMBs) manage their finances. AI is not just a back-office automation tool, it’s an intelligent finance colleague that enables businesses to plan smarter, budget accurately, and forecast effectively.

Our platform provides a comprehensive financial view for SMBs while also offering banks real-time insights via API. This enables financial institutions to provide personalized lending products, increasing fee revenue by up to 8x and deposit balances by 10x.

But while AI is advancing rapidly, its adoption in finance remains a mix of technological potential and human hesitation. Let’s explore what AI will replace, the resistance it will face, and the path forward.

The Resistance: What AI Faces Before Holistic Adoption in Finance

We want to credit Secret CFO for highlighting these key points of resistance in the newsletter dated February 08, 2025, “Run, the bots are coming”.

1. High-Stakes Judgment Calls: AI Is Capable, But Will We Let It?

AI can already model financial scenarios, forecast trends, and crunch numbers faster and more accurately than humans. Yet, final decision-making still sits with people not because AI is incapable, but because we are resistant to handing over control to something that can’t be held accountable.

Currently, a junior analyst running the numbers isn’t allowed to sign off on a multi-million-dollar acquisition without oversight. The same logic applies to AI. Businesses demand human accountability when things go wrong, which is why AI’s role is limited not by technology but by our willingness to trust it.

Could this resistance be temporary? The financial industry has historically resisted automation, yet over time, once-traditional roles from manual bookkeeping to stock trading have become AI-driven. Judgment-based financial decisions may follow the same trajectory but our hunch is it will be a while

2. Accountability & Ownership: Who Takes the Blame When AI Makes a Mistake?

One of the biggest hurdles to AI replacing human decision-making is the question of accountability. An AI colleague can’t be fired. AI co-worker can’t be sued…yet. So who is responsible when AI-driven financial decisions go wrong?

Currently, businesses are structured around human liability. A CFO or executive must take responsibility for financial outcomes. If AI makes a flawed decision, does accountability fall on the developers, the data providers, or the company using the AI? Until regulation clarifies AI accountability in finance, organisations will be reluctant to grant AI final authority over high-risk financial decisions.

Yet, this doesn’t mean AI won’t be the primary intelligence behind financial decisions. As AI-driven insights become more transparent and auditable, executives may shift from making decisions to approving AI-generated recommendations a step closer to full AI-driven finance.

We should also remember AI is a technology; and like other technologies, solutions or products in a business, there are chains of responsibility. For e.g. procurement & supplier agreements when purchasing AI solutions. Or quality control, testing and governance when building in-house or even Human resource policies when thinking about how a colleague (human or one comprised of bits). These frameworks are still relevant in this current era of development.

3. Relationships & Human Trust: AI Will Influence Financial Decisions, But Will We Accept It?

Investor relations, executive negotiations, and boardroom discussions have always relied on human intuition and trust (and sometimes follow-up discussions at the bar). But AI-driven investor agents are already handling analysis, forecasting, and risk assessments so what’s stopping full end-to-end adoption?

The answer: perceived trustworthiness.

AI agents could become sophisticated enough to engage in financial negotiations, but decision-makers still feel more comfortable with human interaction. This is not because AI lacks technical ability, but because human emotions, biases, and trust networks also influence business decisions.

However, AI will inevitably play a bigger role in financial decision-making going forward. AI-powered workplace agents are evolving to become indistinguishable from human colleagues in day-to-day interactions. At some point, we may no longer know whether we’re speaking to a human or AI about a given financial strategy.

Paradoxically, AI may actually create more space for human connection by reducing administrative burdens, allowing finance professionals to focus on strategic collaboration instead of routine tasks.

“The future of work with AI is making our work less robotic - AI can do the mundane robotic stuff that usually gets in the way of effective discussions and communication" - Marie Speakman, Founder Finance Innovation Now, speaking on CloudFO webinar From Insight to Impact in 2024.

AI’s Role in Financial Automation: What’s Already Changing?

AI in Accounts Receivable, Payable, and Month-End Close

AI is not just automating traditional finance processes, it is fundamentally transforming them. While automation in Accounts Receivable (AR) and Accounts Payable (AP) has already become widespread without AI, there is still more to be done. Instead of merely streamlining existing workflows, AI will make financial operations adaptive, autonomous, and intelligent.

We are already seeing AI-driven finance bots handle invoice negotiations, track outstanding payments, and optimise cash flow management without human intervention. These systems not only automate repetitive tasks but can soon make real-time adjustments based on financial data patterns, reducing inefficiencies and ensuring businesses maintain healthy financial positions.

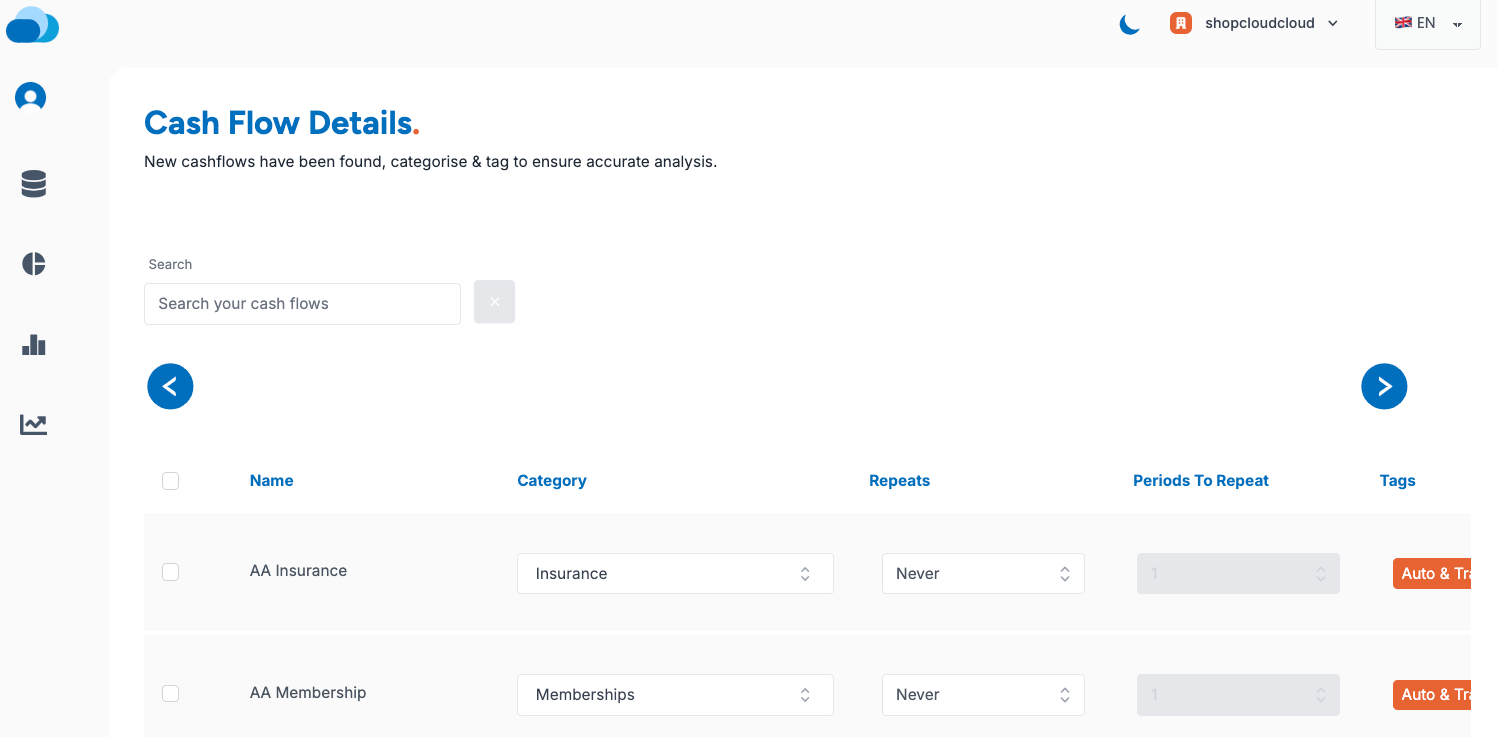

Whilst CloudFO isn't an accounting tool there are some similar paintpoints like categorising and reconciling transactions and cashflows. We recently updated our platform to auto-categorise cashflows, which can then be reviewed by users in seconds rather than manually tagging for hours on end. This means our analysis agent workflows can be more accurate.

The month-end close process is another area ripe for AI-driven disruption. Current regulations still require human oversight in accounting, but AI is already taking over automated draft reconciliations, with accountants merely reviewing the final outputs. Given sufficient training data, AI systems can:

- Follow standard accounting procedures (SOPs) with at minimum the same accuracy as humans.

- Detect anomalies and flag potential issues in real-time, allowing for faster intervention.

- Reduce the month-end close cycle from several weeks to just a few hours.

As AI continues to improve in compliance, monitoring and financial accuracy, we will see a shift towards AI-generated financial statements becoming the standard. In the future, human involvement will primarily focus on regulatory compliance reviews, while AI will handle the bulk of financial reconciliation, reporting, and decision support.

The choice isn’t whether AI will change finance, it’s whether you’ll be ready to adapt and leverage it to your advantage. Those who embrace AI-driven finance now will be the ones saving time, money, and making smarter and faster decisions, which is what every CFO wants. The future of finance isn’t just coming, it’s already here, and CloudFO is leading the way. - Heerad Zahedi, Senior Finance Business Partner, Onfido

Transforming Financial Planning & Analysis (FP&A) with AI

AI is revolutionising Financial Planning & Analysis (FP&A) by shifting finance professionals from manual data processing to strategic decision-making. Traditionally, financial teams have spent considerable time producing reports, analysing performance, and generating forecasts. These processes, while necessary, have been slow and reactive. AI is transforming this landscape by automating repetitive tasks, reducing inefficiencies, and enabling real-time financial insights.

A McKinsey survey found that 90% of CFOs now use scenario-based planning, a shift accelerated by COVID-19. AI is continuing to drive this transformation by blending deterministic and probabilistic forecasting models, allowing businesses to make more resilient and adaptive financial strategies. However, on average, these modelling processes can take months, and often only three scenarios are run to make a strategic decision. As you can imagine when a decision is needed with more urgency, (as is becoming more common) there isn't really time for this lengthy scenario modelling process.

Rather than replacing finance professionals, AI is enhancing their capabilities by providing data-driven recommendations at speeds and scales that were previously impossible. The ability to analyse multiple scenarios, predict future financial trends, and automate complex forecasting models is allowing finance teams to focus on higher-value activities such as strategic planning, risk management, and business development.

Finance professionals are in a great place to lead with AI and be the finance business partners their companies need”. - Marie Speakman, Founder Finance Innovation Now, speaking on CloudFO webinar From Insight to Impact in 2024.

Performance Analysis & Reporting: Moving Beyond Backward-Looking Data

One of AI’s most immediate impacts on finance is the transformation of performance analysis and reporting. Traditionally, finance teams have spent significant time compiling historical financial reports on average 3 days per month, conducting variance analysis, and producing financial dashboards. However, by the time these reports are finalised, the business environment may have already changed, rendering many of these insights outdated and less actionable.

AI is addressing this challenge by automating financial reporting, and delivering real-time insights that enable businesses to react instantly to changing financial conditions. Instead of waiting for month-end reports, executives can access up-to-the-minute performance metrics, with AI dynamically generating forecasts based on current trends. AI-driven self-service dashboards further empower decision-makers to access financial insights on demand, reducing reliance on finance teams to pull ad hoc reports manually. This shift allows finance professionals to move away from producing reports and instead focus on interpreting and actioning insights that drive business success. CloudFO is doing just this for SMEs with instant insight and automated reports sent to their inbox

"Working with AI colleagues means we can reduce low value-add tasks and enable more insights … if I had an AI team member I would get them to do the recurring painful manual reporting we have to do. Not just reporting but insightful commentary so we can take action on more strategic work" - Mong-Trang Sarrazin CFO at Unmind speaking on CloudFO webinar From Insight to impact in 2024.

CloudFO delivers your finance reports to your inbox

Budgeting & Financial Planning: AI’s Role in Real-Time Forecasting

Budgeting has traditionally been a time-consuming and resource-intensive process, with many companies taking up to 77 days to finalise annual budgets. The rigidity of this system often leaves businesses unable to adapt to rapid changes in the economy, market conditions, or internal financial performance. More concerning is the fact that nearly 46% of small and medium-sized businesses (SMBs) do not budget at all, often due to time constraints, lack of expertise, or limited financial resources.

AI is reshaping financial planning by making forecasting more accessible, adaptive, and real-time. Instead of relying on static annual budgets, businesses can now utilise AI-driven continuous forecasting to adjust financial plans dynamically based on real-time data. AI identifies patterns, anticipates potential risks, and suggests adjustments before financial issues arise, allowing companies to proactively manage their finances rather than reactively responding to setbacks.

Furthermore, AI is helping to democratise financial intelligence by providing powerful forecasting tools to businesses that previously lacked access to such capabilities. Large enterprises have long benefited from advanced financial modelling, but at CloudFO we are levelling the playing field by making these tools available to smaller businesses through our intuitive colleague. This shift ensures that companies of all sizes can make data-driven financial decisions with the same level of sophistication as larger corporations.

The Role of AI in Complex Financial Systems

AI in finance is not limited to Large Language Models (LLMs), which have gained significant attention in recent years. While LLMs excel at processing unstructured data, traditional Machine Learning (ML) models have long been used in structured financial analysis. An advantage can be gained by combining deterministic and probabilistic models to enhance forecasting accuracy and explainability.

Deterministic models, powered by traditional machine learning, excel in processing structured financial data such as cash flow projections, revenue forecasts, and expense tracking. These models offer high accuracy and consistency, making them ideal for well-defined financial calculations. However, financial markets and business environments are inherently uncertain, requiring a more flexible approach.

This is where probabilistic models, such as LLMs, become invaluable. Unlike deterministic models, probabilistic AI can better account for uncertainty, variable dependencies, and nonlinear financial interactions. By integrating both deterministic and probabilistic approaches, as we do at CloudFO, AI can handle both structured and unstructured financial data, making financial predictions more robust and adaptable to real-world complexities.

For example, finance executives won’t have to be limited to two or three scenarios when making major business decisions due to time constraints. AI, on the other hand, can generate and evaluate hundreds or even thousands of possible financial outcomes, providing executives with a much broader perspective on potential risks and opportunities. This does not mean that AI replaces human decision-makers, but rather, AI enhances their ability to make well-informed strategic choices by presenting them with a wider range of possibilities.

AI’s Role in High-Stakes Financial Decision-Making

AI’s ability to model financial scenarios with unprecedented depth raises a key question: Will AI eventually make better financial decisions than humans?

While AI can process huge volumes of data and simulate various strategic scenarios, some might argue that it lacks human instincts, emotional intelligence, and ethical considerations. Many believe that business decisions are based purely on financial optimisation, but in reality, factors such as ethics, brand reputation, relationships, and human emotions like ego, ambition, or fear also play a role in decision-making, every day in business. AI can certainly recommend the most mathematically optimal financial decision, but does this remove the human elements that shape businesses and economies? Would AI-driven decision-making eliminate the emotional and ethical dimensions that influence corporate strategy? And if so, is that necessarily a bad thing?

As The Author Morgan Housel points out in the Book Psychology of Money :

- People often seek quick wins and react emotionally to short-term market fluctuations rather than focusing on long-term gains.

- Humans tend to focus too much on daily noise rather than preparing for rare but impactful events e.g. covid.

- We attribute success to skill and failure to bad decisions when in reality luck and risk are two sides of the same coin.

We must recognise that much of what we call intuition in finance is actually subconscious pattern recognition. AI is now performing this same function at scale. While executives may rely on their experience and gut feelings, AI is learning patterns across thousands of historical financial scenarios, identifying hidden correlations that human decision-makers may overlook.

Taking this even further, financial modelling is becoming more intuitive, dynamic, and real-time. If AI has successfully replicated human decision-making processes in digital twins of businesses, incorporating structured and unstructured financial signals, then at some point, AI will be capable of making decisions as well-informed as a human executive.

It is entirely feasible that in the near future, AI could have access to the same data inputs as human decision-makers, and possibly even more. Imagine a world where AI can perceive all the same signals we do in real-time, not just from structured financial reports, but from market sentiment, global economic shifts, and even human behavioural cues.

Looking even further ahead, we could reach a stage where AI is integrated into our daily experiences through wearables or even embedded devices, enabling it to hear, see, and analyse everything that human executives do. If AI has access to the same level of real-world perception as a human, can we still argue that it won’t make better financial decisions?

Ok we got a bit Sci-Fi ... But right now AI must and will evolve beyond just data analysis but becoming a tool that presents complex insights in an intuitive and digestible way. Think about the history of weather forecasting; it's one of the most complicated use cases of modelling and forecasting. historically required supercomputers and complex models but we get it presented to us as "Hey there’s a 60% chance of rain today" - that’s where we see complex modelling of business decisions heading.

Overcoming Barriers to AI-Driven Financial Decision-Making

Despite AI’s transformative potential, there are additional barriers that also must be overcome before AI becomes the standard in financial decision-making.

Building Trust in AI-Driven Insights

One of the biggest challenges is human comfort and trust in AI-generated financial decisions. Many businesses hesitate to rely on AI because they fear it may introduce errors, biases, or unpredictable outcomes. To address this, AI must become more explainable and transparent, ensuring that finance professionals understand how AI reaches its conclusions. Without this visibility, businesses will struggle to fully trust AI-driven financial recommendations. Newer reasoning models like DeepSeek and Open AI 3.0 mini are already addressing this.

Regulatory & Compliance Challenges

Current financial regulations are designed for human decision-makers, not AI-driven systems. For AI to be widely adopted in finance, regulatory frameworks must evolve to provide clear guidelines on AI accountability, auditability, and compliance standards. Businesses need assurances that AI products and offerings align with legal and ethical requirements. Until these frameworks are in place, companies will remain cautious about allowing AI to fully automate financial processes. It's noteworthy that most existing financial and compliance regulations apply to any company using AI just as they do for any other technology they may use. For example GDPR, data privacy and Anti Money laundering. CloudFO is a regulated product under the Financial Conduct Authority complying with the regulator for the use of Open Banking data.

Security & Ethical Considerations

Introducing AI into any business requires the same scrutiny and oversight as with any other technology implementation including identifying cybersecurity threats, bias in financial modelling, and ethical concerns. Without these safeguards, businesses can expose themselves to greater risks.

In summary

AI is no longer a futuristic concept in finance. It is here! Actively transforming everything from forecasting and financial modelling to automation and strategic decision-making. While its adoption still faces challenges around accountability, trust, and regulatory concerns, history has shown that technological progress in finance is inevitable.

As AI continues to evolve, its role must extend beyond number-crunching to providing clear, explainable, and actionable insights that finance professionals can trust. AI in finance must become more accessible and practical for decision-makers at all levels.

At CloudFO, we are leading this change by making AI-powered financial intelligence available to SMBs; businesses that have traditionally lacked access to such advanced insights. By leveraging real-time AI-driven forecasting and financial modelling, we empower companies to plan smarter, forecast with greater accuracy, and make more informed strategic decisions without the time and resource constraints of traditional financial planning.

The future of finance is not about replacing humans, it’s about enhancing human intelligence and decision-making at scale. Businesses that embrace AI-driven finance today will gain a competitive advantage, making faster, smarter, and more resilient financial decisions in an increasingly uncertain world.